If you’ve just stepped into the stock market, you might have come across the term BTST trade and wondered what it really means. Don’t worry—it’s not as complicated as it sounds. BTST simply stands for Buy Today, Sell Tomorrow, and as the name suggests, it lets you sell shares the very next day after buying them, even before they get delivered to your Demat account.

This blog will guide you through the basics of BTST in trading—how it works, why traders use it, and the risks you should be aware of.

BTST full form is Buy Today, Sell Tomorrow. It’s a short-term trading facility that allows you to sell the shares you purchased a day earlier, even before they are delivered into your Demat account. In simple words, if you buy a stock on Monday, you can sell it on Tuesday without waiting for the settlement process to complete.

In India, stock trades usually follow a T+1 settlement cycle, which means that the delivery of shares happens on the next working day after your purchase. But BTST trading gives you the benefit of selling those shares before they actually reach your account. This makes it different from both intraday trading (where buying and selling happen on the same day) and delivery trading (where you hold shares for a longer time).

The main purpose of BTST is to give traders the chance to take advantage of quick price movements in the stock market. For example, if a company announces strong quarterly results after market hours and you expect the stock price to rise the next day, you can buy shares today and sell them tomorrow to book profits, without waiting for delivery.

In India, most equity transactions follow a T+1 settlement system. This means that if you buy shares today (T day), they’ll be credited to your Demat account on the next working day (T+1).

Now, here’s where BTST comes into play:

This works because stock exchanges allow you to sell securities even before they’re visible in your Demat account, as long as the settlement is in process. Your broker takes care of adjusting the transaction in the backend.

Let’s take a simple example. Suppose you buy 50 shares of Reliance Industries on Monday. By Tuesday morning, if the stock price rises and you sell those shares, it becomes a BTST trade. Even though the shares will only be delivered to your account on Tuesday (T+1), the system uses your pending buy position to fulfil your sell order.

Placing a BTST trade is almost the same as buying and selling shares through your regular broker. There’s no special feature or separate button for BTST—it’s simply about how you manage the timing of your buy and sell orders. Here’s how it usually works:

While BTST trading looks simple, there are a few important points you must keep in mind to avoid unwanted losses:

In short, BTST in trading can be profitable, but you need to be careful with stock selection and risk management.

Crafting a winning BTST strategy requires a mix of careful stock selection, technical analysis, awareness of market events, and strict risk management. Since this trading style focuses on very short-term price movements, even small mistakes can result in losses.

The foundation of any BTST trade is picking the correct stock. Traders usually prefer large-cap or index-based stocks because these have high liquidity and lower chances of delivery issues. When there’s enough volume in a stock, it becomes easier to enter and exit positions without worrying about finding buyers or sellers.

On the other hand, penny stocks or highly illiquid shares carry a higher risk of auction penalties in case of non-delivery. That’s why successful traders often focus on stocks that are already showing strong momentum or have solid fundamentals supporting them.

BTST trading is heavily dependent on technical cues because the time horizon is too short for fundamentals to play out completely. Charts and indicators help identify possible entry and exit points. Traders often watch candlestick patterns, especially on 15-minute charts, to spot breakouts near support and resistance levels. The last hour of trading, typically after 2 pm, is considered crucial because intraday traders start closing their positions. A strong breakout during this period often signals strength for the following session. Technical indicators like Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can be used to confirm whether the trend has enough momentum to sustain.

While technicals give clues about price direction, external events often drive short-term movements in the stock market. Traders planning a BTST trade should stay updated on company-specific news such as quarterly earnings, dividend announcements, buyback offers, or major business deals. Even sectoral or economy-wide updates, like RBI’s monetary policies or global market cues, can significantly impact stock prices overnight. Entering a BTST trade just before such events can be profitable if the news aligns with market expectations, but it also carries added risk if the outcome is unfavourable.

One of the most important aspects of a BTST strategy is discipline in setting targets. Before entering the trade, decide at what price you will buy, what profit level you aim for, and where you’ll place your stop-loss. For instance, if you purchase a stock at ₹200, you might set a profit target of ₹210 and a stop-loss at ₹195. This way, even if the market moves against you, your losses are limited. Having a predefined plan prevents emotional decision-making, which is common in short-term trading.

Timing plays a huge role in BTST trades. Since you only hold the stock for a single day, the point of entry can determine whether you end up with a profit or a loss. Traders often look for opportunities in the last 30 to 45 minutes of the trading session, when the market is more volatile due to intraday square-offs. If a stock breaks resistance levels during this period, it could indicate strong buying pressure that may continue into the next session, making it a good BTST candidate.

Finally, no BTST strategy is complete without proper risk management. Because these trades carry overnight risk, you can’t control external factors like global market movements or unexpected news after market hours. To minimise the impact, avoid putting all your capital into a single stock and never use excessive leverage. Spreading trades across a few liquid stocks and keeping a strict stop-loss ensures that one wrong move doesn’t wipe out your profits

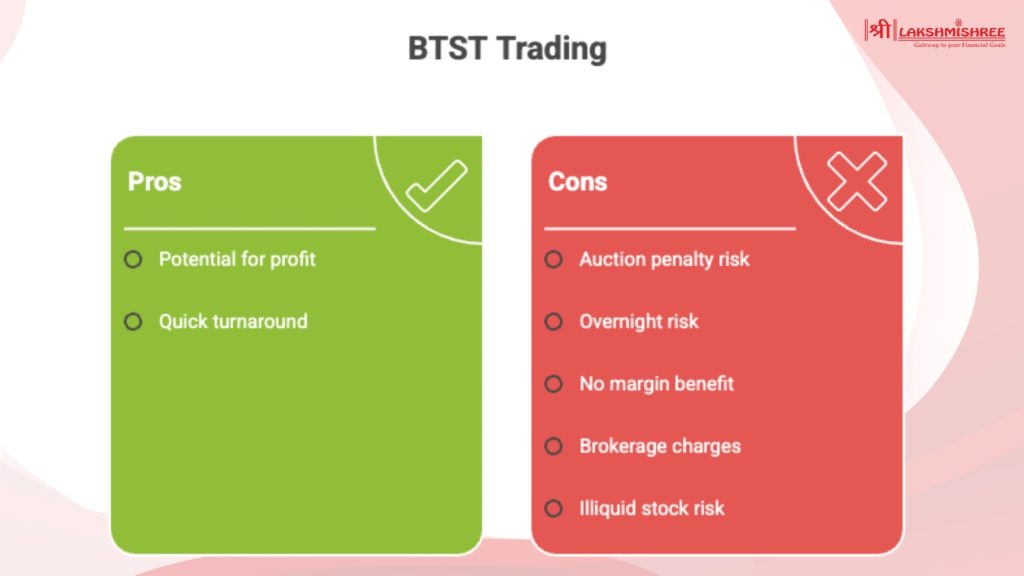

BTST trading offers several benefits for traders who want to make the most of short-term opportunities in the stock market. Some of the key advantages are:

While BTST trading has its advantages, it also carries certain risks that traders should be aware of before entering such trades. Some of the main disadvantages are:

The BTST trading strategy is mostly used by traders who want to take advantage of short-term price movements without locking their money for long. Since BTST in stock market allows you to sell shares the very next day after buying, it is ideal for participants who are comfortable with quick decisions and overnight risks.

Here are the types of traders who commonly use BTST:

Many traders often get confused between BTST, intraday, and delivery trading because all three involve buying and selling shares. The difference lies mainly in the holding period, settlement process, and the level of risk. Here’s a simple comparison to help you understand how they work:

| Feature | BTST Trading (Buy Today, Sell Tomorrow) | Intraday Trading | Delivery Trading |

|---|---|---|---|

| Holding Period | 1 day (buy today, sell next day before delivery) | Same day only (must square off before market closes) | More than 1 day, can hold for weeks, months, or years |

| Settlement | Shares not yet in Demat, but sell allowed the next day | No delivery, positions squared off daily | Shares delivered to the Demat account after T+1 |

| Capital Requirement | Full amount required (no intraday margin benefit) | Lower capital needed due to leverage/margin | Full amount required |

| Risk Factor | Overnight risk + possible auction penalty | High intraday volatility, but no overnight risk | Market risk depends on holding duration |

| Best Suited For | Short-term traders looking for overnight opportunities | Active traders seeking quick daily profits | Long-term investors building wealth |

| Brokerage & Charges | Charged like delivery trades | Lower brokerage on intraday trades | Delivery charges + STT applicable |

BTST full form is Buy Today, Sell Tomorrow, and it simply means buying shares on one day and selling them the very next day before they are credited into your Demat account. This BTST trading strategy works as a middle ground between intraday and delivery, giving traders a chance to capture short-term price movements without waiting for settlement. It can be useful for retail traders and swing traders who actively follow market trends, charts, and news.

BTST in stock market means Buy Today, Sell Tomorrow. It is a trading facility that allows you to sell the shares you purchased on the next trading day, even before they are credited to your Demat account. This helps traders capture short-term price movements without waiting for the normal T+1 settlement cycle.

The main difference between BTST and intraday trading is the holding period. In intraday, you must buy and sell shares within the same trading day, and no delivery takes place. In BTST, you buy the stock today and sell it the next day, before actual delivery, which makes it a hybrid between intraday and delivery trading.

BTST trading can be safe if beginners choose liquid, large-cap stocks and follow strict stop-loss levels. However, it carries risks such as overnight volatility and auction penalties if shares are not delivered. Beginners should start with small quantities, gain experience, and then increase their exposure in BTST trades.

No, BTST is not advisable in every stock. It works best in liquid, high-volume stocks that are part of indices like Nifty or Sensex. Illiquid or penny stocks carry a higher risk of delivery failure, which can lead to penalties and unexpected losses.

The biggest risks in BTST trade are auction penalties if the shares you bought are not delivered, and overnight risks where global events or negative news can affect prices before the next market opening. Since no intraday margin is available, you also need to invest the full capital for BTST in trading.

BTST allows you to sell stocks the very next day after purchase, even before they appear in your Demat account. In delivery trading, you actually take delivery of the shares into your account and can hold them for as long as you want. This makes BTST a short-term trading style while delivery is suitable for long-term investing.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.