If you invest in the stock market, you might have encountered the term TPIN while trying to sell shares from your Demat account. But precisely what is TPIN, and why is it required? Simply put, Transaction Personal Identification Number is a unique security code issued by CDSL to authorise the selling of stocks. It acts as a safeguard, ensuring that only you can approve transactions from your Demat account.

In this guide, we’ll explore what TPIN means, why CDSL introduced it, how to generate it, and how to use it to sell shares.

Key Takeaways – TPIN Full Form

TPIN stands for Transaction Personal Identification Number, a unique 6-digit security PIN issued by CDSL (Central Depository Services Limited). It authorises the sale of shares from a Demat account without relying on a broker. It ensures that only the account holder can approve stock transactions, making the process more secure and transparent.

Before this, most investors had to sign a Power of Attorney (PoA), giving brokers full control to sell shares. This system had risks, as brokers could misuse access. To address this, CDSL introduced TPIN, allowing investors to authorise transactions themselves without PoA. It is required for off-market transfers, share pledging, and selling stocks directly from a Demat account.

Once a pin is generated, it remains the same until it is changed or reset by the investor. CDSL sends an authorisation request whenever a stock is sold, which must be approved using TPIN before the transaction is processed. This added layer of security protects investors from unauthorised trades.

It is essential for traders as it provides direct control over share transactions in a Demat account. It acts as an extra security layer, ensuring that only the investor can authorise the sale of shares without relying on a broker.

With Pin, traders have better security, transparency, and investment control. It is required for:

✔ Selling shares from a Demat account

✔ Off-market share transfers

✔ Pledging shares for margin trading

✔ Revoking previously approved transactions

It ensures that no unauthorised transactions occur, making stock trading safer and more reliable for retail investors.

Also Read: CDSL Business Model | How does CDSL make money?

TPIN is a one-time authorisation PIN that allows investors to approve share sales and transfers directly from their Demat account. Unlike OTPs, which change with every transaction, Pin remains the same unless reset by the investor.

Here’s how it works when selling shares:

In Punjab National Bank (PNB), T-PIN is used for telephone banking services to verify transactions over calls. A 4-digit security PIN allows customers to access their accounts, check balances, and perform banking transactions without visiting a branch.

Unlike CDSL Transaction Personal Identification Number, which is used for Demat account transactions, PNB Pin is specific to banking services. It ensures secure access to financial details and prevents unauthorised transactions. Customers can generate, reset, or update their PNB number through the bank’s helpline or online banking portal.

You can generate your CDSL Transaction PIN online in just a few minutes. Follow the steps below:

Steps to Generate Online:

Your CDSL Transaction Code is now ready! You will need the same whenever you authorise the sale of shares or make off-market transactions. Make sure to keep it secure and avoid sharing it with anyone.

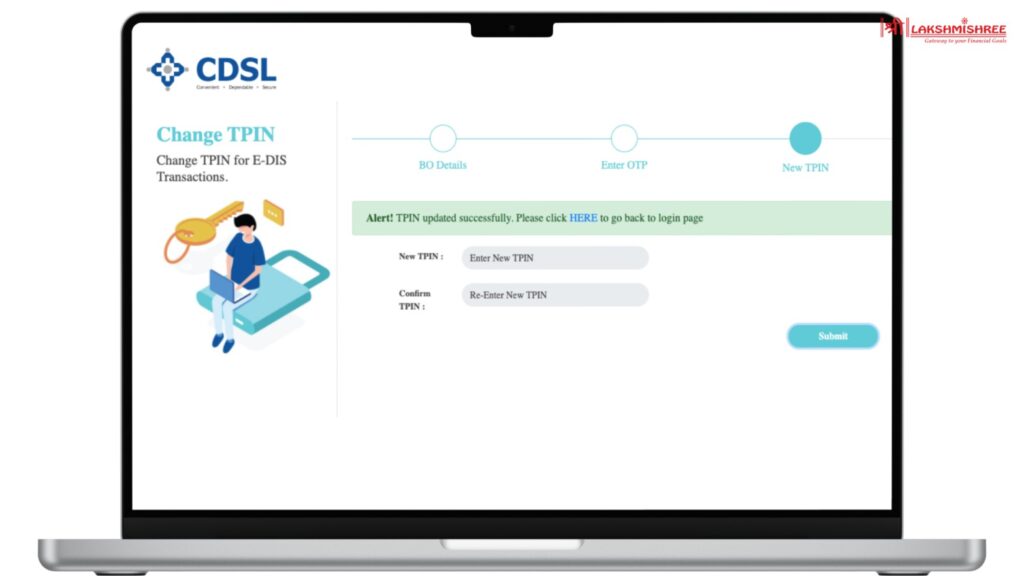

If you want to update your TPIN for security reasons or because you've forgotten it, CDSL provides an easy way to reset it. Changing your CDSL code ensures your Demat account remains secure and protected from unauthorised access.

Steps to Change Online:

Your new CDSL transaction code is now active! Use it whenever you need to authorise share sales or other transactions from your Demat account.

You must authorise the transaction using your CDSL code to sell shares from your Demat account.

Steps to Sell Shares:

If you don’t want to enter Transaction Personal Identification Number every time you sell shares, you can opt for DDPI (Demat Debit and Pledge Instruction), a legally authorised alternative. DDPI allows brokers to automatically debit shares from your Demat account, eliminating the need for transaction code authorisation before every transaction.

Earlier, traders relied on Power of Attorney (PoA) to authorise share transactions, but due to security risks, PoA was replaced with CDSL Transaction code. However, DDPI is now the most convenient way to bypass TPIN without compromising security. Unlike PoA, DDPI only permits brokers to sell shares as per your instructions without giving them complete control over your holdings.

Steps to Enable DDPI:

Once DDPI is active, you won’t need to enter the CDSL code before selling shares. The broker will automatically authorise share transfers as per your sell orders, saving time and effort while keeping your transactions secure.

Also Read: Understanding Margin Trading in Modern Investment

MPIN and TPIN serve different purposes in financial transactions. MPIN (Mobile Banking Personal Identification Number) is used to log into mobile banking apps and authorise fund transfers, whereas Transaction Personal Identification Number is used to approve share transactions in a Demat account.

MPIN is specific to banking transactions, while transaction code is essential for stock trading and investment security. Transaction code ensures that only the investor can approve share sales, reducing the risks associated with broker access.

Key Differences Between MPIN and TPIN:

| Feature | MPIN | TPIN |

|---|---|---|

| Purpose | Used for mobile banking login and transactions | Used for share transaction authorisation in a Demat account |

| Where It Is Used | Bank apps (UPI, net banking) | Stockbrokers and Depository (CDSL) |

| Length | 4-6 digits | 6 digits |

| Security Level | Secures mobile banking access | Prevents unauthorised share transfers |

| Verification Method | Entered during login or fund transfer | Required for approving share sales or off-market transfers |

| Alternative Option | Can be reset via banking portals | Can be bypassed using DDPI |

Transaction Personal Identification Number is designed to provide high-level security for Demat account transactions, ensuring that only the investor can authorise share sales. Unlike Power of Attorney (PoA), which grants brokers full access to holdings, TPIN limits transaction approvals to the account holder, reducing the risk of unauthorised trades.

To maintain security, investors should:

✔ Keep it confidential – Never share your code with anyone, including brokers.

✔ Regularly update Code– Changing your PINperiodically helps prevent security breaches.

✔ Use DDPI if needed – If you frequently trade, enabling DDPI can prevent unauthorised transactions while bypassing Transaction Personal Identification Number verification.

CDSL TPIN is an essential security feature that allows investors to authorise share sales directly from their Demat accounts without relying on brokers. It eliminates the risks associated with Power of Attorney (PoA), ensuring full control over share transactions. Investors can easily generate, reset, or update their Transaction PIN through the CDSL website. For frequent traders, enabling DDPI (Demat Debit and Pledge Instruction) can streamline the process by bypassing Transaction Personal Identification Number verification.

TPIN stands for Transaction Personal Identification Number is a 6-digit security PIN issued by CDSL to authorise the sale of shares from a Demat account. It ensures that only the investor can approve transactions, replacing the need for Power of Attorney (PoA).

You can generate your CDSL PIN online by visiting the CDSL website or your broker’s platform. Enter your BO ID (Beneficiary Owner ID), verify with OTP authentication, and set a new code . A confirmation will be sent to your registered mobile number and email.

Once generated, Transaction Personal Identification Number remains valid indefinitely unless you reset or change it. However, if you do not use TPIN for a long period, you may need to re-authorise your transactions.

If you forget your CDSL TPIN, you can reset it online through the CDSL portal. Enter your Demat account details, verify with OTP authentication, and create a new code. A confirmation message will be sent to your registered mobile number and email.

Yes, you can bypass TPIN verification by enabling DDPI (Demat Debit and Pledge Instruction) with your stockbroker. DDPI allows brokers to debit shares from your Demat account automatically when you sell them, eliminating the need to enter CDSL code for every transaction.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.