The Securities and Exchange Board of India (SEBI) has made investing cheaper and more transparent for retail investors by reducing mutual fund base expense ratios. While the cut, ranging from 10 to 15 basis points (bps), may seem minor, it significantly impacts an investor’s long-term savings by ensuring more capital remains invested and compounds over time.

Key Changes to Expense Ratios:

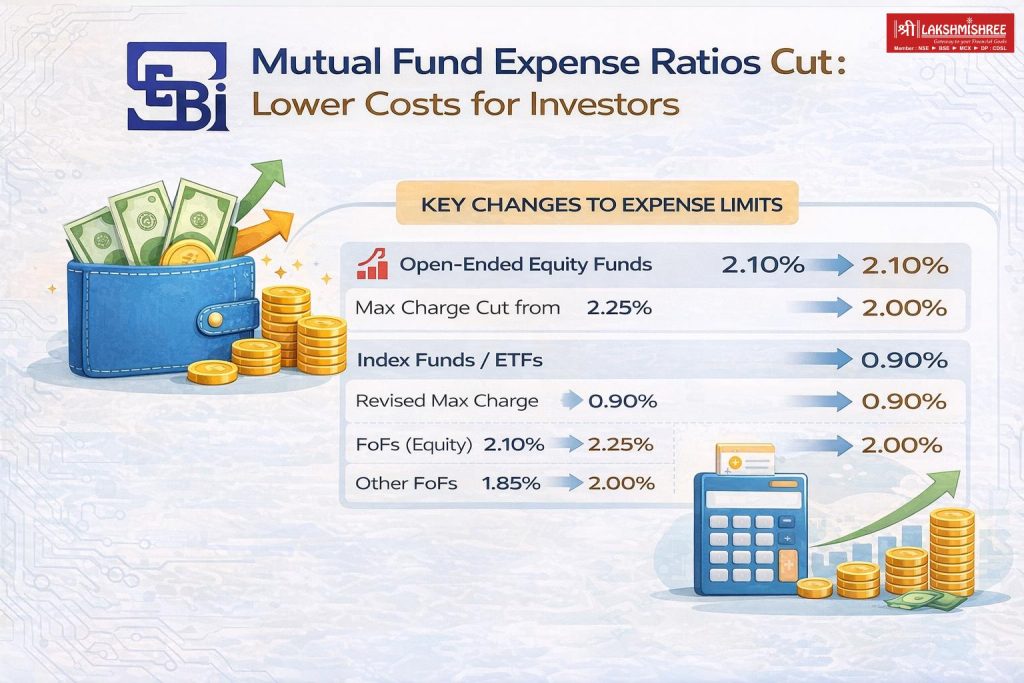

- Reduction in Limits: Expense ratios have been lowered by up to 15 bps, with most asset classes seeing a 10 bps cut.

- Revised Expense Limits for Specific Funds (Excluding Statutory Levies):

- Index funds/ETFs: Revised to 0.90% (from 1.00% including levies).

- FoFs (Liquid schemes/Index funds/ETFs): Revised to 0.90% (from 1.00% including levies).

- FoFs (≥ 65% AUM in equity-oriented schemes): Revised to 2.10% (from 2.25% including levies).

- Other FoFs: Revised to 1.85% (from 2.00% including levies).

Shift from TER to BER for Enhanced Transparency

SEBI has simplified the disclosure of costs by renaming the Total Expense Ratio (TER) to the Base Expense Ratio (BER).

- BER: This now includes only the core fund operating costs, such as fund management fees, distributor commissions, and RTA charges.

- Cost Clarity: The shift separates core fund expenses (BER) from statutory levies (GST, STT, stamp duty, etc.), which will be shown separately. BER reflects the fund house’s charge, while TER represents the final cost to the investor after adding taxes.

The Power of Small Savings Over Time

The 10-20 bps reduction in expense ratios has a significant, compounding effect over long investment horizons.

- Long-Term Wealth Generation: Investing is a long, steady march. For example, A 20-basis point cut on a Rs 10 lakh portfolio invested for 20 years can result in an additional wealth of nearly Rs 2.95 lakh.

- Direct Saving: This gain is not from market performance but is money saved from fees, which then stays invested to compound. For long-term goals, this seemingly small reduction can make a meaningful difference to the final corpus.

News Desk