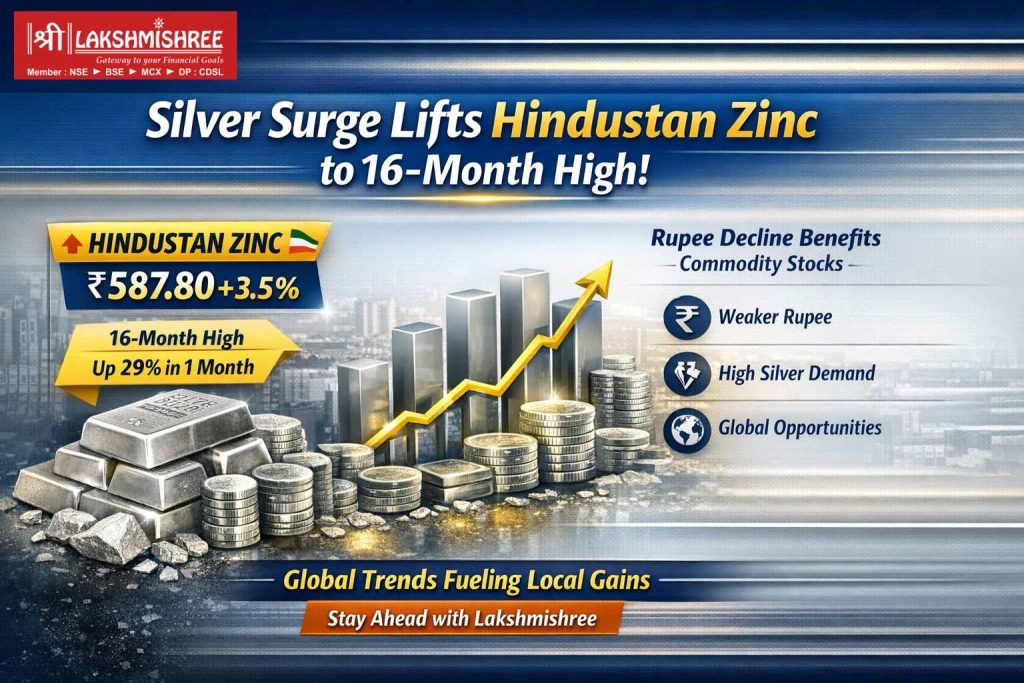

Hindustan Zinc shares jumped over 3.5% on December 17, 2025, reaching a 16-month high of ₹587.80 amid a sharp spike in global silver prices. The stock has surged nearly 29% in less than a month, marking a strong rebound from its March low of ₹378.15.

This rally is tied closely to the record-breaking move in silver futures. Contracts with March, May, and July expiry crossed ₹2.05 lakh/kg, ₹2.08 lakh/kg, and ₹2.12 lakh/kg respectively, setting new all-time highs. Globally, spot silver breached the $66/oz mark for the first time.

Why Hindustan zinc matters

Hindustan Zinc is India’s largest silver producer. As silver prices soar, the company’s margins and earnings potential strengthen, attracting investors. Silver’s dual identity in industrial and precious metal makes it highly responsive to changes in global demand and macroeconomic conditions.

With rising silver use in solar, electronics, and electric vehicles, the metal is becoming a long-term growth story coming ahead from just a cyclical hedge. Domestic interest and exposure is also growing through Silver ETFs and digital platforms.

Stock Performance and History

From a low of ₹378.15 in March, the stock has jumped about 55% in nine months. However, it still trades far below its all-time high of ₹1,443 per share, which it hit in January 2011. This shows that while the stock has gained recently, it has not yet returned to its historical peak levels.

What It Signals for Investors

The timing of this price action also connects closely with recent macroeconomic developments. As highlighted in recent rupee’s fall past 91/USD is creating tailwinds for export aligned and globally priced sectors. Hindustan Zinc’s domestic production and international pricing advantage make it a natural beneficiary of this currency trend.

The silver rally and Hindustan Zinc’s rise could be early signs of a shift. As India expands its manufacturing base and clean energy capacity, demand for industrial metals is only set to rise. Combined with rupee weakness, these dynamics may continue to boost domestic producers with global pricing power.

Read more about sector-specific trends on our [Market Insight blog].

News Desk