Finance Minister Nirmala Sitharaman presented the Union Budget 2026-27 on Sunday, February 1, 2026. While there were no changes to income tax rates or slabs, the biggest news for taxpayers is the official transition to the Income Tax Act, 2025, which replaces the decades-old 1961 law starting April 1, 2026.

The Direct Tax Highlights

The government’s focus this year shifted from changing “how much” you pay to “how easily” you pay.

- New Income Tax Act 2025: A complete overhaul of the 1961 Act designed to simplify language, remove outdated rules, and reduce legal disputes. Familiar deductions (like Section 80C) are being restructured and renumbered into a more logical framework.

- Extended Revision Window: You can now revise your filed tax returns until March 31 (previously December 31) upon payment of a nominal fee, giving you three extra months to correct errors.

- Staggered Filing Deadlines: To manage the server load, deadlines are now varied:

- ITR-1 and ITR-2: Remain July 31.

- Non-audit businesses and trusts: Moved to August 31.

- Lower TCS for Overseas Spending: Tax Collected at Source (TCS) for overseas tour packages, foreign education, and medical purposes has been slashed from 5% (or 20%) to just 2%.

- New Tax Exemptions:

- Accident Claims: Interest awarded by the Motor Accident Claims Tribunal is now fully tax-exempt.

- Armed Forces: Specific exemptions were provided for disability pensions for the Armed Forces and paramilitary personnel.

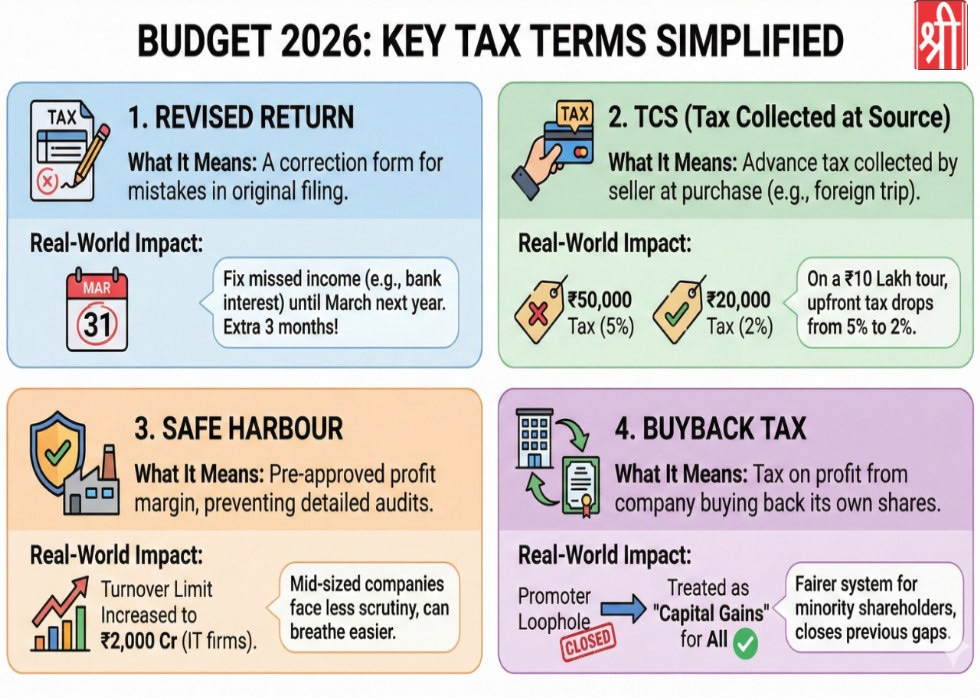

Here is the simplified glossary of the key tax terms from Budget 2026, broken down to show exactly how they affect your wallet:

Revised Return

• What it is: A “correction form” used to fix mistakes or add missed income after you’ve already filed your taxes.

• Real-World Impact: You now have until March 31st of the following year to fix errors. If you forgot to declare bank interest in July, you have three extra months to correct it without a major legal headache.

• TCS (Tax Collected at Source)

• What it is: An advance tax collected by a service provider (like a travel agent or bank) when you spend money on specific luxury or foreign items.

• Real-World Impact: The rate for foreign trips and education has been slashed from 5% to 2%. A ₹10 Lakh foreign tour package that used to require a ₹50,000 upfront tax payment will now only require ₹20,000.

Safe Harbour

• What it is: A “green channel” for companies where the government accepts their declared profit margins (fixed at 15.5% for IT) without detailed auditing.

• Real-World Impact: The eligibility limit was raised from ₹300 crore to ₹2,000 crore. This means mid-sized IT companies can focus on growth instead of answering constant questions from tax officers.

Buyback Tax

• What it is: The tax paid when a company buys its own shares back from investors.

• Real-World Impact: This is now taxed as Capital Gains for all shareholders. It closes a loophole that promoters used to avoid higher taxes, ensuring that minority shareholders get a fairer, more transparent deal.

The “Why” Behind the Change

The intent of the Budget 2026 is to move India toward “Viksit Bharat 2047” by making the tax system digital-first and user-friendly. By freezing tax rates and focusing on administrative ease, the government aims to increase transparency and trust among middle-class taxpayers.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.