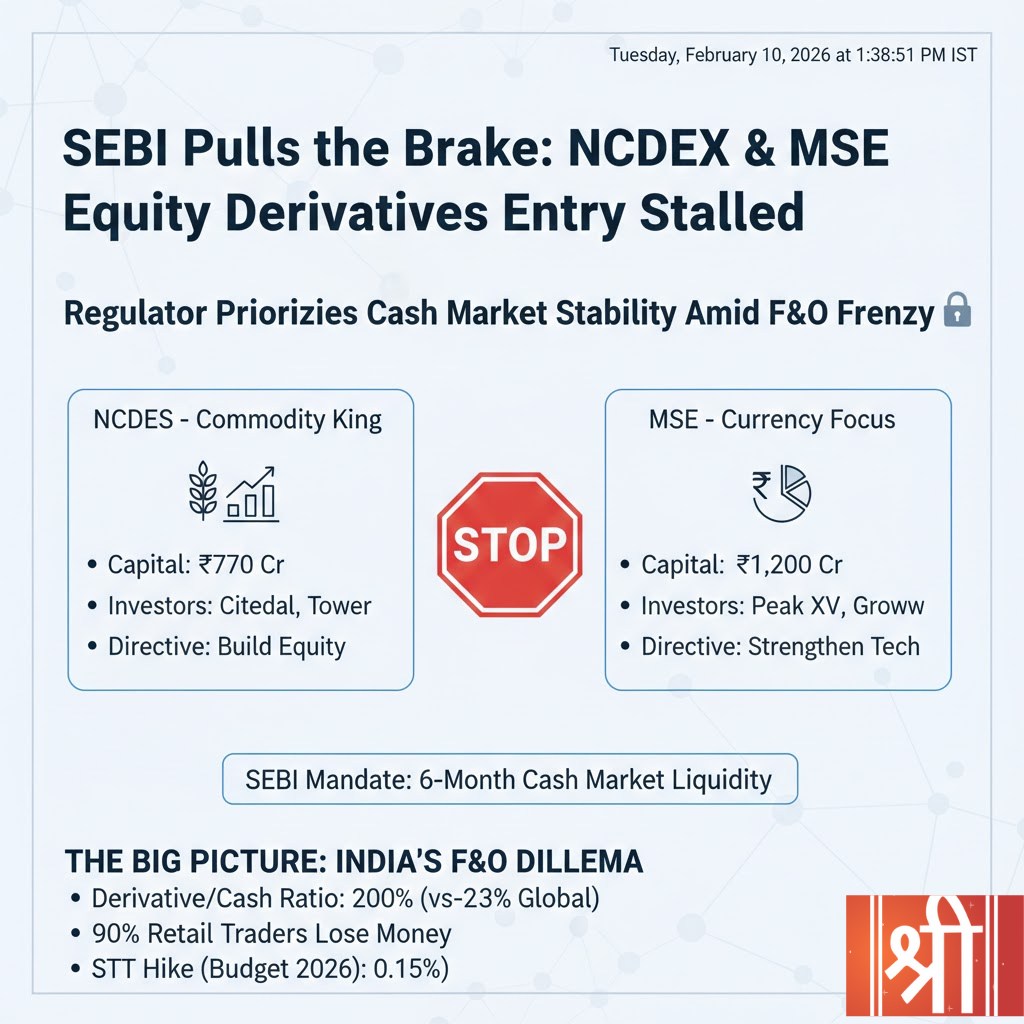

In a significant move to safeguard market integrity, the Securities and Exchange Board of India (SEBI) has reportedly halted the entry of India’s two newest exchange contenders—the National Commodity and Derivatives Exchange (NCDEX) and the Metropolitan Stock Exchange (MSE) into the high-stakes equity options market.

This decision comes at a time when India’s derivatives volume has reached a fever pitch, prompting the regulator to enforce a “Cash Market First“ doctrine.

The “Stability First” Doctrine: Why SEBI Paused the Launch

SEBI’s directive is centered on a strategy of Market Maturation. The regulator is concerned that allowing new players to launch complex derivatives without a solid foundation could further inflate speculative bubbles.

- The Six-Month Liquidity Mandate: SEBI has established a new “cooling-off” hurdle. Exchanges must now operate a liquid cash (equity) market for at least six months before they can even apply for derivative products. This ensures that the “underlying” asset has genuine price discovery before leverage is added.

- The Technology Benchmarking: Beyond liquidity, SEBI has flagged Technical Robustness as a non-negotiable prerequisite. Both exchanges must undergo rigorous technology audits to ensure they can handle high-frequency trading (HFT) and the massive surge in message traffic typical of the options segment.

- The Retail Safety Net: With recent studies confirming that 90% of retail investors lose money in Futures & Options (F&O), SEBI is avoiding “fueling the fire.” By limiting the number of venues for speculative trading, the regulator aims to steer retail participants back toward long-term cash equity investments.

Financial Muscle vs. Regulatory Hurdles

Both NCDEX and MSE spent 2025 building “war chests” to challenge the NSE/BSE duopoly. Despite their strong backing, they now face an enforced waiting period.

| Feature | NCDEX Strategy | MSE Strategy |

| Capital Raised (2025) | ₹770 Crore (via Preferential Issue) | ₹1,200 Crore (via Private Equity) |

| Strategic Partners | Citadel Securities, Tower Research (Global HFT giants), Acacia Partners | Peak XV, Groww, Zerodha unit |

| Current Footprint | Dominates Agricultural Commodities | Strong in Currency Derivatives |

| The Challenge | Must pivot from Agri-focus to building a Mainboard Equity Cash business. | Must scale Equity Volumes, which currently remain “thin” compared to peers. |

The 2026 Macro Environment: Why Now?

This regulatory block does not exist in a vacuum. It is part of a broader “cooling” strategy implemented in early 2026:

- Taxation Headwinds: The Union Budget 2026-27 recently increased the Securities Transaction Tax (STT) on options premiums (from 0.1% to 0.15%), directly impacting the profitability of high-frequency and retail scalping strategies.

- Derivative-to-Cash Imbalance: In major global economies, the derivative market is roughly 2%–3% of the cash market. In India, it is nearly double (200%) the size of the cash market. SEBI views this as a systemic risk.

- Surveillance Snapshots: New rules now require exchanges to conduct at least four random intraday snapshots of positions to prevent outsized margin-less bets.

The Verdict for Investors

For the broader market, SEBI’s message is clear: Stability over Speed. While NCDEX and MSE are “IT Ready” and backed by the world’s most sophisticated trading firms (Citadel and Tower), they must now prove they can attract genuine long-term investors to their cash segments.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.