Lakshmishree Research Desk | December 26, 2025

Shares of Indian railway-linked companies witnessed a sharp rally on Friday, December 26, following the implementation of revised passenger train fares. The surge was led by state-owned majors including Rail Vikas Nigam Ltd (RVNL) and the Indian Railway Finance Corporation (IRFC), which registered gains of up to 12% in intraday trade. The market movement coincides directly with the government’s operationalization of the second fare hike of the calendar year, a move projected to bolster the Indian Railways’ revenue stream significantly for the remainder of the fiscal year.

Railway Stocks Performance Statistics

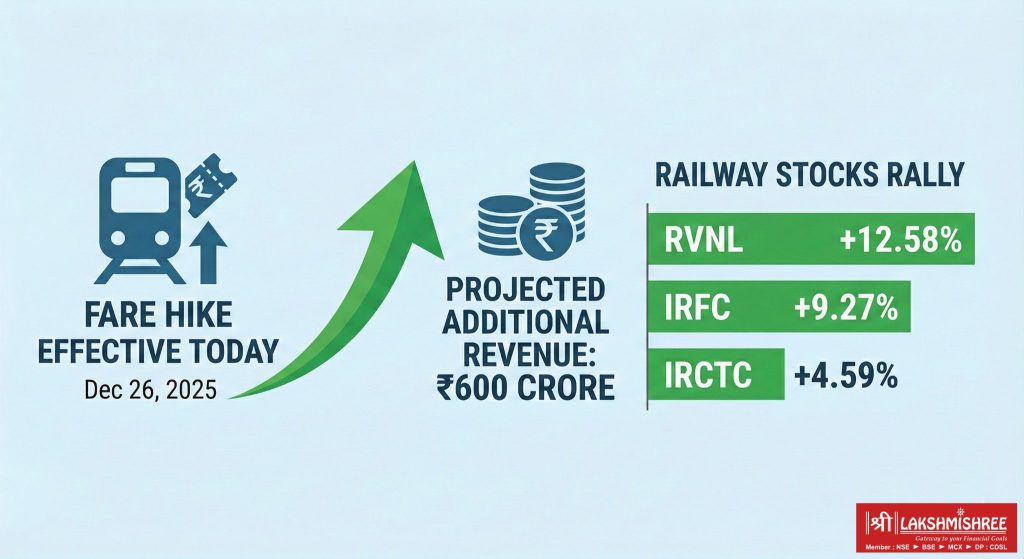

The rally was broad-based, covering engineering, finance, and ticketing segments of the railway ecosystem. As of 12:11 IST on the National Stock Exchange (NSE), the specific performance data for key stocks was as follows:

- Rail Vikas Nigam Ltd (RVNL): The top gainer among railway PSUs, RVNL shares climbed 12.58%, trading at ₹389.20. RVNL functions as the construction arm of the Ministry of Railways, executing project development and financing.

- Indian Railway Finance Corporation (IRFC): The dedicated market borrowing arm of the Indian Railways saw its shares rise by 9.27%, reaching a price of ₹132.75.

- Indian Railway Catering and Tourism Corporation (IRCTC): The monopoly player in online ticketing and catering services gained 4.59%, trading at ₹710.85.

- Jupiter Wagons: A key player in the private sector wagon manufacturing space, the stock was up 2.85% at ₹350.30.

- RailTel: Shares of the telecom infrastructure provider also traded in the green, contributing to the sector-wide momentum.

Train Fare Hike: Rates and Revenue Projections

The primary trigger for the market activity is the revised fare structure which became effective on Friday morning. According to the official statement released on Thursday, the hike aims to rationalize passenger fares across different categories of travel.

Revised Rate Structure: The Ministry of Railways has implemented a tiered hike based on the category of the train:

- Non-Mail and Non-Express Trains: Fares for Sleeper, AC, and non-AC classes have been increased by 1 paisa per kilometer.

- Mail and Express Trains: Fares for these faster categories have been increased by 2 paise per kilometer.

- Exemptions and Distance-Based Slabs The Ministry clarified that suburban services and season ticket holders are exempt from this hike, shielding daily commuters. For ordinary non-AC trains, the hike is graded by distance: no increase for journeys up to 215 km, a ₹5 hike for 216–750 km, and up to ₹20 for distances beyond 1,751 km. However, premium trains like Vande Bharat, Rajdhani, and Shatabdi will see the standard 2 paise/km hike across all classes. The Ministry cited rising manpower costs and network expansion as primary drivers for this second revision of the year.

Fiscal Impact: Official estimates indicate that this revision is expected to generate additional revenue of approximately ₹600 crore for the Indian Railways in the remaining months of the fiscal year 2025-26. This marks the second time fares have been adjusted in 2025, signaling a continued effort to improve the operating ratio of the national transporter.

Triggers and Corporate Developments

While the fare hike served as the macro-trigger, specific corporate developments also fueled the rally. Market data indicates that the initial momentum in the sector began with Jupiter Wagons. A sharp rise in its stock price followed the conversion of a preferential issue by the company’s promoter. This corporate action acted as a catalyst, with buying interest subsequently spilling over to other railway engineering, procurement, and construction (EPC) companies.

Summary of Key Facts

- Top Gainer: RVNL (+12.58%).

- Effective Date of Hike: December 26, 2025.

- Revenue Projection: ₹600 crore (FY 2025-26).

- Hike Magnitude: 1 paisa/km (Ordinary) to 2 paise/km (Mail/Express).

- Sector Trend: Positive movement across public (PSU) and private railway stocks.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.