February 10, 2026 / 16:15 IST

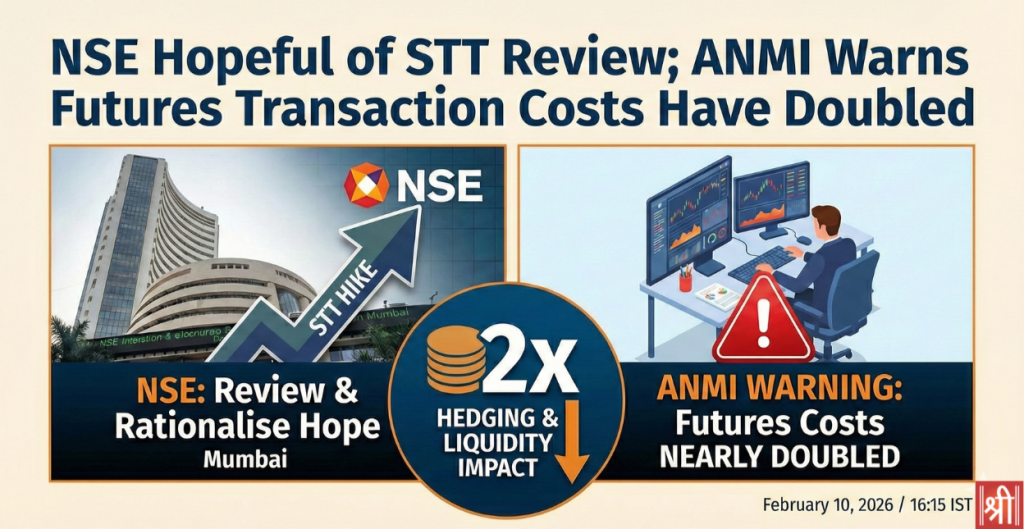

Mumbai: The National Stock Exchange (NSE) is hopeful that the recent hike in Securities Transaction Tax (STT) on Futures and Options (F&O) trades will be “reviewed and rationalised” by the government. During an investor call on Monday, the exchange management noted that the market had anticipated a reduction in STT for the cash segment in the Union Budget, but instead faced a hike across both futures and options.

Key Highlights:

- NSE Outlook: Management confirmed that multiple representations have been made to the government to reconsider the hike.

- Cost Impact: Broker body ANMI warned that total transaction costs in the futures segment have nearly doubled.

- Hedging Concerns: Higher STT is viewed as a significant negative for index and stock futures, which are primary tools for long-term investors to hedge risk.

Impact of STT review on Hedging and Liquidity

NSE management highlighted that while the market often absorbs cost increases, the current hike disproportionately affects futures. “Futures are generally seen as genuine instruments for hedging by long-term investors. They are not the instrument of choice for short-term traders,” the management stated.

The exchange expressed concern that rising transaction costs could reduce the attractiveness of futures for risk management. While periodic increases in STT haven’t historically led to a sustained decline in volumes, the management admitted it is currently “difficult to predict” the long-term impact on derivatives participation.

ANMI Urges Government Intervention

The Association of National Exchanges Members of India (ANMI) has formally urged a review, pointing out a stark disparity in the tax burden. According to ANMI, while transaction costs for options rose by a modest 3%, the costs for futures trading have surged by nearly 100%.

The broker body warned that since Indian markets are already costlier than global peers, this hike could hurt market stability, liquidity, and overall vibrancy. Retaining the earlier STT structure, ANMI argued, is essential to restore investor confidence.

Regulatory Discussions Ongoing

On the proposal to withdraw calendar spread margin relief, the NSE noted that discussions are currently active between broker associations and regulators. The exchange also pointed to the Securities Lending and Borrowing (SLB) framework as a potential area for reform to support cash market liquidity. A SEBI-constituted working group is currently reviewing the SLB mechanism to improve market depth.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.