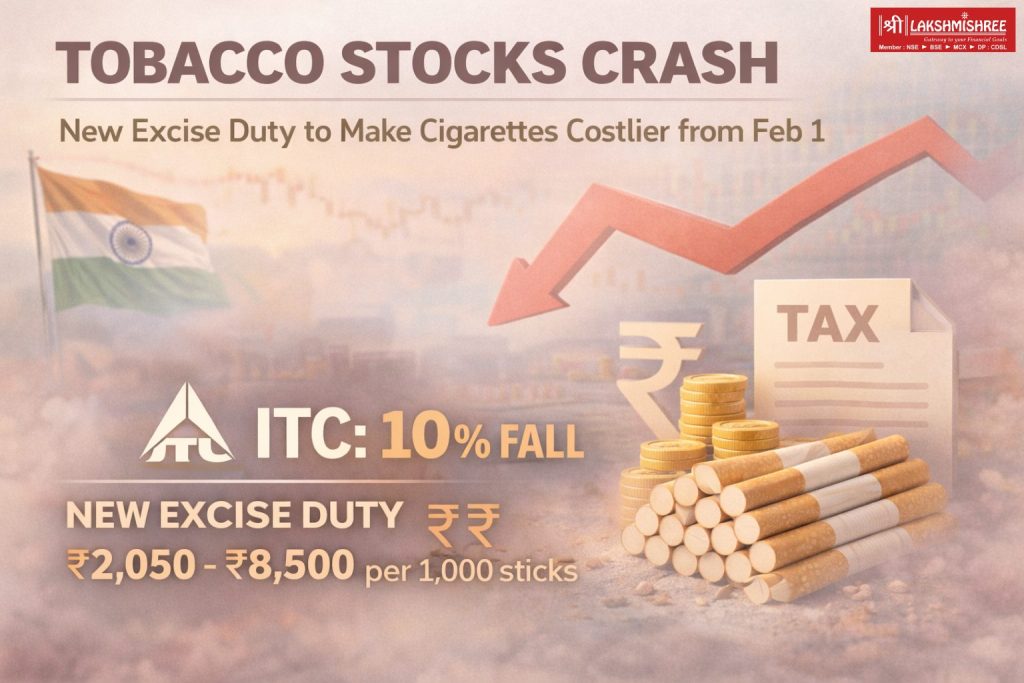

Shares of tobacco companies fell sharply on January 1 after the government notified a new excise duty structure on cigarettes and tobacco products, marking a significant overhaul of the sector’s tax framework. ITC shares declined nearly 10%, touching levels close to a three-year low and recording their steepest single-day fall in almost four years.

The selling pressure followed a late-evening notification by the Finance Ministry on December 31, which introduced an additional excise duty on cigarettes to take effect from February 1, 2026. The new levy comes alongside a higher GST rate and replaces the existing compensation cess that is set to end after the repayment of GST-related loans to states.

Other tobacco stocks also witnessed heavy losses. Godfrey Phillips India fell sharply, while VST Industries also ended lower, reflecting broad-based weakness across the tobacco sector.

Cigarettes, Pan Masala to Get Costlier from February 1

Under the revised tax structure, cigarettes and other tobacco products will attract 40% Goods and Services Tax (GST) along with a fresh excise duty, substantially increasing the overall tax burden.

The government has notified an excise duty ranging from ₹2,050 to ₹8,500 per 1,000 cigarette sticks, depending on cigarette length. This excise duty will be levied over and above GST, marking a shift from the earlier compensation cess mechanism.

Key features of the revised tax regime include:

- 40% GST on cigarettes and tobacco products

- Excise duty of ₹2,050–₹8,500 per 1,000 sticks, based on length

- 18% GST on bidis

- A Health and National Security Cess on pan masala and chewing tobacco

- Removal of GST compensation cess, effective after January 31, 2026

The changes follow Parliament’s approval of the Central Excise (Amendment) Bill, 2025, which provides the legal framework for higher duties on cigarettes and tobacco. The Finance Ministry has also notified new rules governing capacity determination and duty collection for chewing tobacco, scented tobacco, and gutkha packing machines.

Market Reaction Reflects Regulatory Reset

The announcement triggered sharp declines across tobacco stocks as investors reacted to the scale and permanence of the tax changes. ITC, which derives a significant portion of its profits from the cigarette business despite having a diversified portfolio, saw particularly heavy selling pressure.

The revised tax structure replaces the compensation cess that was originally introduced in 2017 to offset state revenue losses following the rollout of GST. The cess was extended multiple times and is now scheduled to end after the repayment of ₹2.69 lakh crore in loans taken by the Centre to compensate states during the Covid period.

Impact on the Tobacco Sector

The new excise-plus-GST framework increases the cost of cigarettes across categories and is expected to lead to higher retail prices from February 1. The move reinforces the government’s long-standing policy approach toward tobacco taxation, combining revenue objectives with public health considerations.

For tobacco companies, the changes introduce a structural shift in the operating environment, with higher taxes becoming a permanent feature rather than a temporary measure. Stock price movements on January 1 indicate that markets are factoring in the long-term implications of the revised regime.

Bottom Line

The notification of a new excise duty on cigarettes, combined with a higher GST rate, represents a significant reset of tobacco taxation in India. The sharp fall in ITC and other tobacco stocks underscores investor sensitivity to regulatory changes in the sector.

With the new tax structure set to take effect from February 1, 2026, cigarettes and pan masala are likely to become more expensive, while tobacco stocks may remain volatile as markets adjust to the revised policy framework.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.