Indian IT companies edged lower on December 24 after the United States announced a major overhaul of its H-1B visa for work allocation system, replacing the long-standing lottery mechanism with a weighted selection process that prioritises higher-paid and more skilled foreign workers.

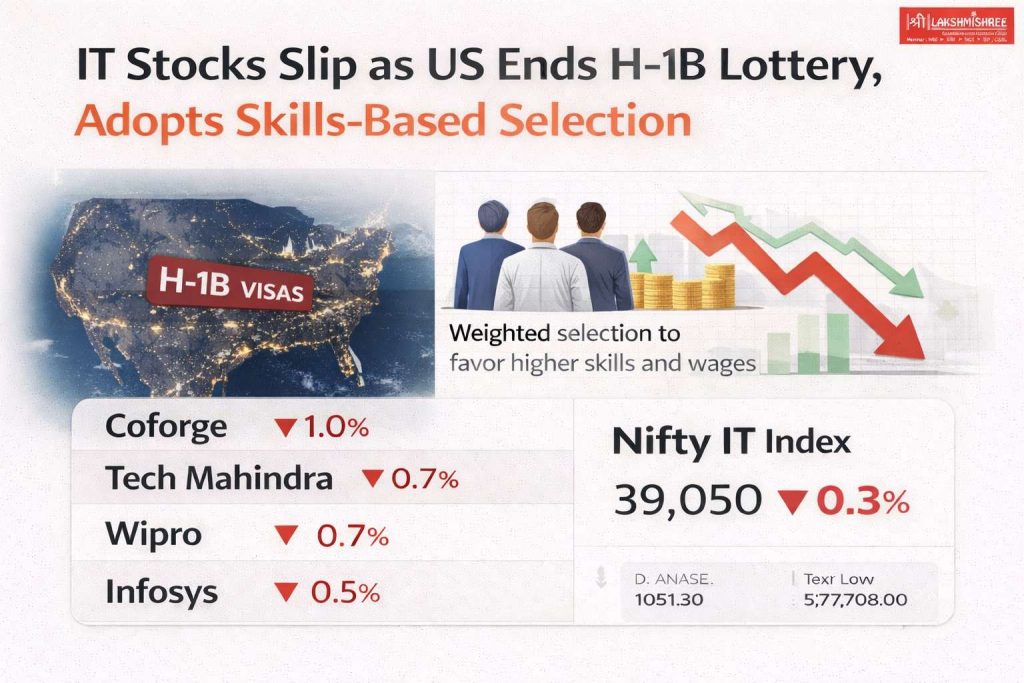

Stocks such as Coforge, Tech Mahindra and Wipro declined between 0.7% and 1%, while Infosys and Persistent Systems fell around 0.5% each. The broader Nifty IT index slipped about 0.3%, extending losses for a second consecutive session after a recent rally.

H-1B System: What Has Changed

The US Department of Homeland Security said that H-1B visas will no longer be allotted through random selection. Instead, applications will be weighted to increase approval chances for professionals offered higher wages and roles requiring advanced skills.

The change aligns with earlier policy moves by the Trump administration, including a proposal that requires employers to pay an additional $100,000 per visa as a condition for eligibility. The new system is set to come into effect on February 27, 2026, and will apply to the upcoming H-1B cap registration season.

Why IT stocks reacted

IT stocks declined after the US announced changes to the H-1B visa system because the move directly affects how Indian technology companies deploy skilled employees in the American market. The new framework prioritises higher-paid and specialised roles, which could increase staffing costs for fresh visa applications. For IT companies that execute large client projects using a mix of onsite and offshore teams, this reduces flexibility in workforce planning. While existing visas and renewals remain unaffected, the change introduces uncertainty around future hiring costs and project staffing. Markets reacted to this potential cost pressure and operational uncertainty, even though there is no immediate impact on current business performance or demand outlook.

The Bigger Picture Behind the IT Stock Reaction

Indian IT stocks reacted to the H-1B rule change because the sector remains structurally linked to US immigration and wage policies. The US contributes 50–65% of revenues for major Indian IT firms, and Indian companies account for over 70% of annual H-1B approvals.

The new system prioritises higher-paid, specialised roles, raising the effective cost of new onsite deployments. While the visa cap remains unchanged at 85,000, access for cost-sensitive roles may narrow, increasing average employee costs for fresh applications.

Over the past decade, Indian IT firms have already reduced H-1B dependence by 30–40%, shifting work offshore and expanding Global Capability Centres in India. However, wage-weighted allocation could slow new project staffing and put long-term pressure on margins, especially for short-cycle contracts.

The market reaction reflects this future cost sensitivity, not an immediate earnings impact, as existing visas and renewals remain unaffected.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.