Indian IT major Infosys Ltd’s American Depository Receipt (ADR) witnessed an exceptional spike in US trading on December 19, driven purely by a technical short squeeze, not by any fundamental trigger.

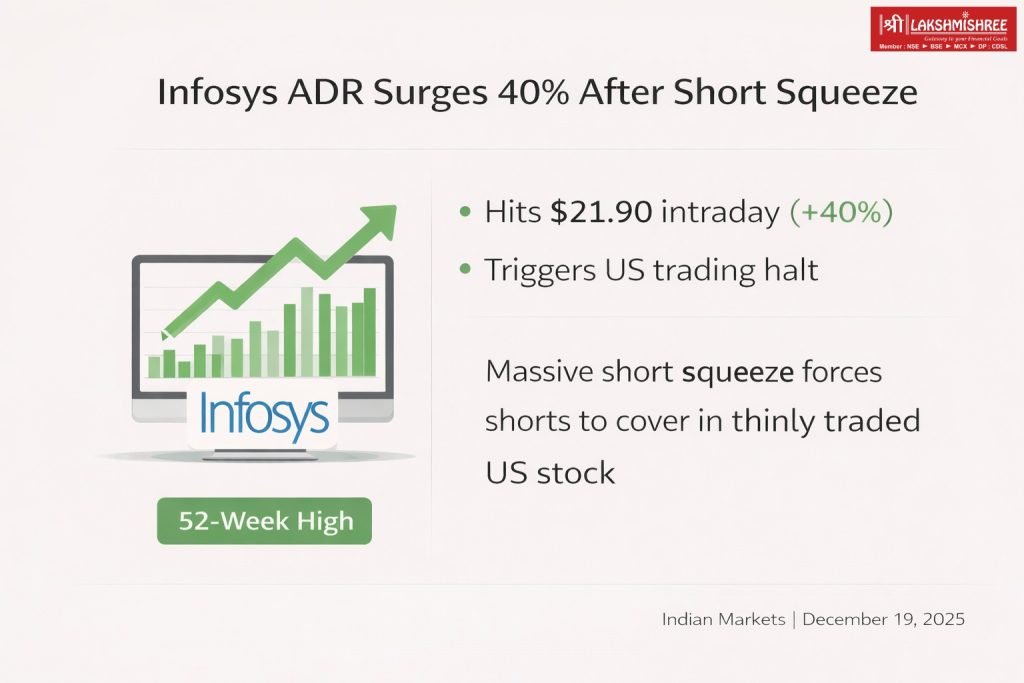

The Infosys ADR surged as much as 40% intraday, touching a 52-week high, before volatility controls led to a temporary trading halt. At around 21:37 IST, the ADR was trading near $21.90, up 14%, after cooling off from peak levels.

What triggered Infosys ADR Surge 40%

Market participants cited a large-scale stock lending recall as the key catalyst. A major lender is believed to have recalled 45–50 million ADR shares, far exceeding Infosys ADR’s normal daily trading volume of 7–8 million shares.

This sudden withdrawal of lendable stock forced traders holding short positions to rush for cover, creating a sharp mismatch between forced buying demand and available liquidity in a relatively thinly traded instrument.

Understanding the short squeeze

A short squeeze occurs when:

- Short sellers are forced to buy shares rapidly

- Borrow availability tightens suddenly

- Daily trading volumes are insufficient to absorb forced covering

Such situations can cause abrupt and outsized price moves, even in fundamentally stable companies

Mechanics of a Large-Scale Recall in Securities Lending

A large-scale recall is when lenders demand the return of loaned securities, forcing borrowers to “cover” their positions and potentially causing a market event.

Key Components:

- Lender’s Right: Lenders can recall securities anytime; while “on term” loans may have penalties, the right to demand the stock remains.

- Borrower’s Obligation: Upon recall notice, the borrower must return equivalent securities quickly (e.g., T+1), compelling them to buy the stock on the open market to cover short sales.

- Market Impact (Short Squeeze): Simultaneous, high-volume recalls, especially for high short interest stocks, create sudden buying demand, leading to a rapid price increase (a “short squeeze”).

Operational Needs: The manual recall process is complex. Shorter settlement cycles (like T+1) necessitate automated solutions to prevent settlement failures

No fundamental signal for IT sector

Market participants stressed that the Infosys ADR spike was purely technical and does not reflect any new development in the company’s business or the broader IT sector.

Recent results from Accenture, reported on December 18, indicated stable global IT demand, with revenue growth at the upper end of guidance and strong bookings in AI and managed services. This has helped reassure investors on the outlook for Indian IT services companies.

Other US-listed Indian IT ADRs including TCS, Wipro and HCL Tech traded within normal ranges, showing no signs of similar dislocations.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.