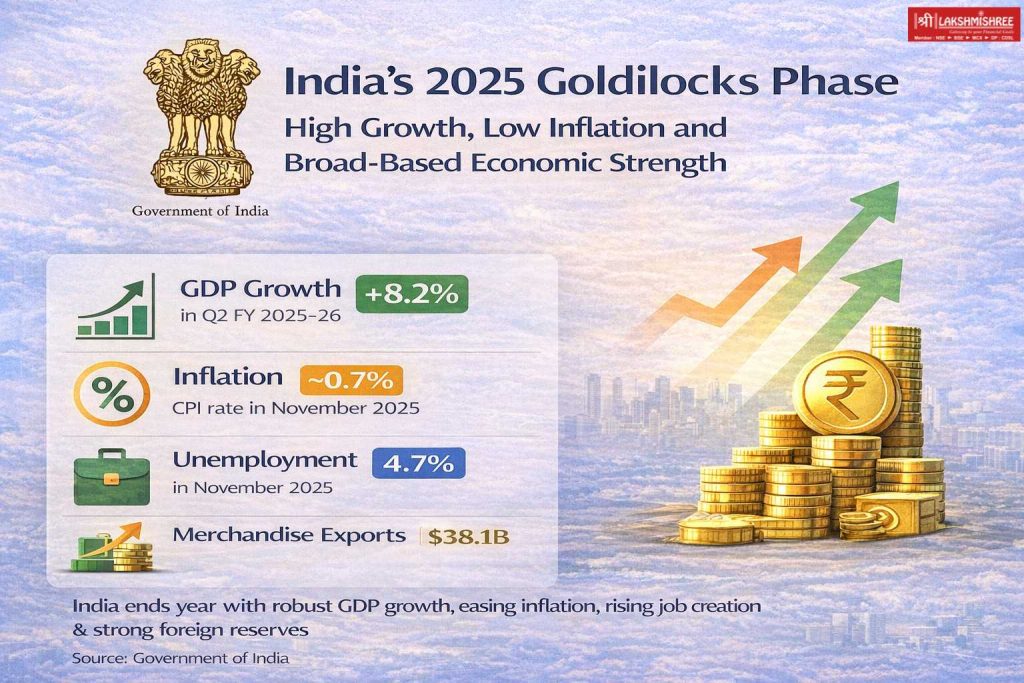

India is set to conclude 2025 on one of its strongest macroeconomic footings in recent history, marked by robust economic growth, sharply easing inflation, improving employment conditions, and rising global confidence. Government data, supported by projections from leading global institutions, point to a rare alignment of growth and stability often described as a “Goldilocks phase” for the Indian economy.

This momentum is not confined to a single sector. Instead, it reflects a broad-based expansion spanning domestic demand, labour markets, inflation management, trade performance, and external sector resilience.

1. Economic Growth: Domestic Demand Leads the Expansion

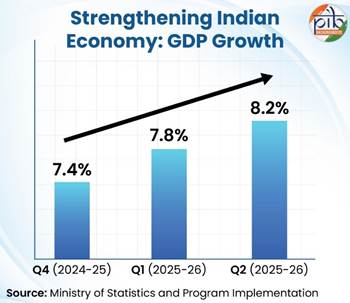

India’s real Gross Domestic Product (GDP) expanded 8.2% in Q2 FY 2025–26, the fastest pace in six quarters, up from 7.8% in Q1 and 7.4% in Q4 of FY 2024–25. The acceleration underscores the economy’s resilience despite ongoing global trade and policy uncertainties.

Growth has been domestically driven, with private consumption emerging as the primary engine. Urban demand strengthened further, supported by rising incomes, stable credit availability, and improved consumer confidence. Government capital expenditure, front-loaded earlier in the fiscal year, also provided a strong multiplier effect across infrastructure-linked sectors.

Real Gross Value Added (GVA) grew 8.1%, led by robust performance in industrial manufacturing and services, highlighting the depth and breadth of the recovery.

Reflecting this momentum, the Reserve Bank of India revised its GDP growth forecast for FY26 upward to 7.3%, from an earlier estimate of 6.8%.

2. Inflation: A Rare Phase of Price Stability

One of the most notable developments of 2025 has been the sharp and sustained decline in inflation. Consumer Price Index (CPI) inflation softened progressively from 4.26% in January 2025 to 0.71% in November 2025, well below the RBI’s medium-term target of 4%.

Food price corrections unusual for the September–October period also played a key role, while core inflation also remained contained. Headline CPI even touched historic lows near 0.25% in October, before edging slightly higher in November.

Wholesale Price Index (WPI) inflation mirrored this trend, slipping to a provisional -0.32% in November, reinforcing the broader price stability environment.

The benign inflation outlook allowed the RBI to cut the policy repo rate by 25 basis points to 5.25%, maintaining a neutral stance while supporting growth. RBI projections now place CPI inflation at 2.0% for FY26, comfortably within the target band.

3. Employment: Falling Unemployment, Rising Participation

India’s improving growth trajectory has translated into tangible gains in employment. According to the latest Periodic Labour Force Survey (PLFS), the unemployment rate declined to 4.7% in November 2025, down from 5.2% in October—the lowest level since April 2025.

The decline has been broad-based, with both rural and urban segments contributing. Notably, unemployment among women fell sharply, signalling improved workforce inclusion.

At the same time, Labour Force Participation Rate (LFPR) rose to 55.8%, while the Worker Population Ratio (WPR) increased to 53.2%, indicating that more people are not only seeking work but also finding employment.

These trends underscore a virtuous cycle: stronger growth leading to higher labour absorption, reinforcing household incomes and domestic demand.

4. Trade and Exports: External Sector Strengthens

India’s trade performance improved steadily through 2025, despite global demand headwinds. Merchandise exports rose from USD 36.43 billion in January to USD 38.13 billion in November, supported by strong shipments of engineering goods, electronics, pharmaceuticals, petroleum products, and agricultural exports.

Several product categories that include cashew, marine products, electronic goods, and engineering goods—recorded double-digit growth, highlighting India’s increasing integration into global value chains.

Services exports remained a key pillar, expanding by 8.65% year-on-year during April–November 2025, driven by software services, business services, and digital exports.

India also diversified its trade relationships, strengthening ties with the UK, UAE, Australia, Europe, and emerging markets, reducing dependence on any single geography.

5. External Sector: Strong Buffers, Rising Confidence

India’s external sector resilience remained intact. Foreign exchange reserves stood at USD 686.2 billion as of late November, providing over 11 months of import cover.

The current account deficit (CAD) moderated to 1.3% of GDP in Q2 FY26, aided by strong services exports and rising inward remittances, which grew 10.7% year-on-year.

Foreign Direct Investment (FDI) flows gained momentum, with gross FDI rising 19.4% during April–September FY26, while net FDI surged due to lower repatriation. Although portfolio flows remained volatile, long-term capital inflows continued to reflect investor confidence in India’s structural story.

6. Global Recognition and Outlook

India’s macroeconomic performance has drawn strong endorsement from global institutions. The World Bank, IMF, OECD, Moody’s, S&P, Fitch, and the Asian Development Bank have all upgraded or reaffirmed optimistic growth projections for India through 2026 and beyond.

With GDP now exceeding USD 4.18 trillion, India has become the world’s fourth-largest economy, and is projected to move further up global rankings over the next few years.

Conclusion: Goldilocks phase

India’s 2025 macroeconomic landscape reflects a rare alignment of high growth, low inflation, falling unemployment, and external stability. Supported by structural reforms, disciplined monetary policy, and strong domestic demand, the economy appears well-positioned to sustain momentum into 2026.

This “Goldilocks phase” offers policymakers, businesses, and investors a crucial window to deepen reforms, expand productive capacity, and ensure that growth remains inclusive and durable as India advances toward its long-term development goals.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.