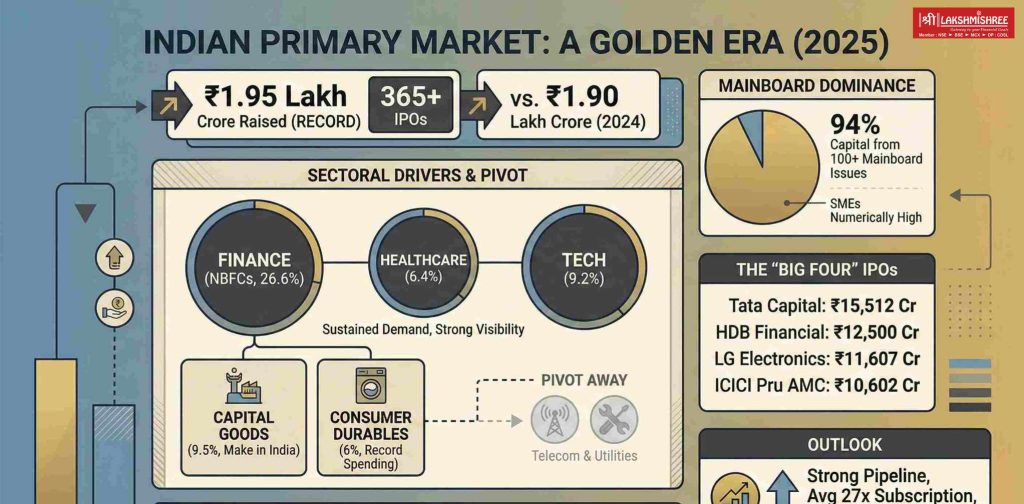

The Indian primary market has closed its most successful year in history. Driven by a surge in domestic liquidity and a shift in household savings toward equities, companies raised a staggering ₹1.95 lakh crore through more than 365 IPOs in 2025. This performance eclipses the previous record of ₹1.90 lakh crore set in 2024, marking a golden era for Indian capital markets.

Sectoral Drivers: Finance, Healthcare and Tech

Non-banking financial companies (NBFCs), healthcare firms and technology companies emerged as the largest contributors to IPO fundraising in 2025. These sectors benefited from sustained investor demand, strong business visibility and improving profitability metrics.

Capital goods and consumer-focused companies played a meaningful role in 2025, highlighting a broad-based expansion rather than a narrow, theme-driven rally. Capital goods alone contributed 9.5% of total activity, fueled by the “Make in India” push and a resurgence in private industrial capex. Consumer durables followed closely at 6%, buoyed by record household spending and a sharp recovery in private consumption growth, which is projected to reach 7.3% for the fiscal year.

In contrast, sectors such as telecom and utilities, which were highly active in earlier cycles (contributing nearly 18% of capital in 2024), saw virtually no IPO activity this year. This dramatic pivot suggests that investors have moved away from legacy infrastructure plays, instead favoring sectors with higher immediate growth visibility, such as manufacturing, high-end retail, and specialty consumer brands.

Mainboard IPOs Dominate Fundraising by Value

While SME and smaller IPOs accounted for a large share of listings numerically, mainboard IPOs dominated in terms of capital raised. Just over 100 mainboard issues contributed nearly 94% of total IPO proceeds, reinforcing the role of large, established companies in anchoring market confidence.

The “Big Four” IPOs of 2025

A handful of mega-listings anchored the year’s fundraising, with the top eight IPOs alone contributing nearly 45% of the total mainboard collection.

Tata Capital: The largest of the year, raising ₹15,512 crore. It was subscribed rapidly on Day 1, reflecting the trust in the Tata brand.

HDB Financial Services: Mobilized ₹12,500 crore, further cementing the NBFC sector’s lead.

LG Electronics India: A massive ₹11,607 crore issue that saw over 50 lakh applications.

ICICI Prudential AMC: Added ₹10,602 crore in December, becoming one of the most valuable AMCs on the street.

Younger Companies Step Into Public Markets Earlier

A notable shift in the past two years has been the age profile of listing companies. Over half of the funds raised came from firms less than 20 years old, reflecting a growing trend of younger businesses accessing public capital earlier in their growth cycle.

Sectoral Scorecard: The Drivers of Growth

While 2024 was the year of Automobiles and Telecom, 2025 saw a pivot toward financial services and manufacturing. NBFCs were the undisputed champions, contributing over a quarter of the total capital.

| Sector | Contribution (%) | Key Drivers |

| NBFCs | 26.6% | High demand for credit, digital lending platforms, and the massive Tata Capital IPO. |

| Capital Goods | 9.5% | “Make in India” initiatives and infrastructure-led manufacturing growth. |

| Technology | 9.2% | Resurgence in new-age digital businesses and software-as-a-service (SaaS). |

| Healthcare | 6.4% | Expansion of diagnostic chains and specialty hospital networks. |

| Consumer Durables | 6.1% | Rising urban consumption and premiumization trends. |

Strong Demand, Selective Outcomes

IPO demand remained robust, with average subscriptions running close to 27 times over the last two years. While more than half of recent mainboard IPOs are trading above issue prices, performance has varied reinforcing the need for disciplined stock selection.

Outlook: Momentum Likely to Continue

Despite a slowdown in alternative fundraising routes such as QIPs and OFS, the IPO pipeline remains strong. Healthy domestic investor participation, steady mutual fund inflows and interest from large corporates suggest that India’s IPO market is transitioning from a cyclical surge to a structural growth phase.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.