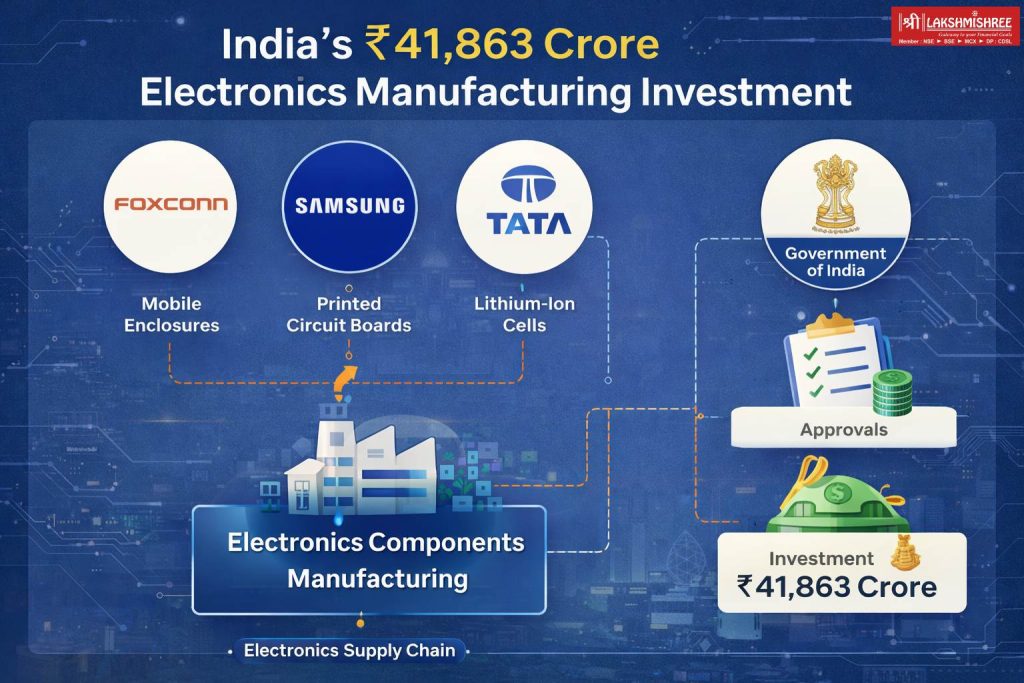

India has approved a ₹41,863 crore electronics manufacturing investment under the Electronics Components Manufacturing Scheme (ECMS), clearing 22 new projects aimed at strengthening domestic supply chains, reducing import dependence, and accelerating high-value manufacturing. The approvals are expected to generate 33,791 direct jobs and production output worth over ₹2.58 lakh crore, marking one of the largest electronics manufacturing clearances in recent years.

The latest tranche represents the third round of approvals under ECMS and comes at a time when the government is aggressively positioning India as a key alternative manufacturing base in global electronics supply chains.

Foxconn, Samsung, Tata Anchor the Electronics Manufacturing Investment Push

A significant share of the approved investment is being driven by Apple-linked supply chain vendors, reinforcing India’s growing role in global electronics assembly and component manufacturing.

Key beneficiaries include Foxconn, Samsung, and Tata Electronics, alongside suppliers such as Motherson Electronic Components, ATL Battery Technology India, and Hindalco Industries. Several of these vendors are expected to integrate deeper into Apple’s global supply network, with components manufactured in India being exported to international markets.

Notably, Devyani-linked Foxconn subsidiary Yuzhan Technology India and Tata Electronics will both set up large mobile enclosure manufacturing units in Tamil Nadu, further consolidating the state’s position as a core electronics manufacturing hub.

Projects Spread Across Eight States

The 22 approved projects will be implemented across eight states—Andhra Pradesh, Haryana, Karnataka, Madhya Pradesh, Maharashtra, Tamil Nadu, Uttar Pradesh, and Rajasthan. According to the Ministry of Electronics and Information Technology, the geographic spread reflects a deliberate strategy to ensure balanced industrial development and reduce regional concentration risks.

Tamil Nadu is expected to see the highest employment generation, with Foxconn’s enclosure project alone projected to create over 16,200 jobs, while Tata Electronics’ unit will add approximately 1,500 jobs.

Where the Money Is Going

The investment distribution highlights the government’s focus on core electronics components, rather than just final assembly.

- Enclosures account for the largest share, with three projects drawing ₹27,166 crore, primarily supporting smartphone and handheld device manufacturing.

- Printed Circuit Boards (PCBs) form the second-largest segment, with nine projects attracting ₹7,377 crore, reflecting the push to localise a critical import-heavy component.

- A ₹2,922 crore lithium-ion cell manufacturing project has also been approved, supporting India’s ambitions in energy storage and consumer electronics.

In total, the approvals cover 11 target product segments, including bare components (PCBs, capacitors, connectors, enclosures, lithium-ion cells), sub-assemblies (camera modules, display modules, optical transceivers), and supply-chain inputs such as aluminium extrusion and laminate materials.

ECMS Gains Momentum Amid Global Supply Chain Shifts

The latest approvals build on earlier ECMS tranches announced in October and November 2025, which together cleared 24 projects involving over ₹12,700 crore in investments. With this round, total ECMS-linked commitments now exceed ₹54,000 crore, indicating strong industry traction.

Combined with India’s semiconductor policy initiatives and the Production-Linked Incentive (PLI) schemes, ECMS is emerging as a central pillar of India’s electronics manufacturing strategy—moving the country up the value chain from assembly to component and sub-assembly production.

Why This Matters for India’s Electronics Supply Chain

The approvals come amid global efforts by multinational firms to diversify manufacturing away from China. By focusing on components rather than only finished goods, India aims to improve unit economics, enhance vendor stickiness, and reduce its exposure to supply disruptions.

Industry experts note that localising components such as PCBs and enclosures is essential for India to compete sustainably with established electronics manufacturing hubs in East and Southeast Asia.

Bottom Line

The ₹41,863 crore electronics manufacturing investment approved under ECMS marks a decisive step in India’s ambition to become a globally competitive electronics manufacturing base. With Foxconn, Samsung, Tata, and Apple-linked suppliers anchoring the expansion, the focus is clearly shifting toward scale, depth, and export integration—rather than short-term assembly-led growth.

If execution remains on track, the current ECMS cycle could materially reshape India’s position in global electronics supply chains over the next three to five years.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.