The Union Budget 2026-27, presented by Finance Minister Nirmala Sitharaman on February 1, 2026, has delivered what many are calling the most human-centric health intervention in recent history. Acknowledging that India’s disease burden is rapidly shifting toward non-communicable diseases (NCDs) like cancer, diabetes, and autoimmune disorders, the government has moved beyond simple policy rhetoric to launch a dual-pronged strategy: aggressive domestic manufacturing and immediate, massive duty cuts. This is not just a budget for hospitals; it is a budget for families currently battling the financial and emotional toll of chronic illness.

Biopharma SHAKTI:

The Outlay for a Self-Reliant Healthcare Hub

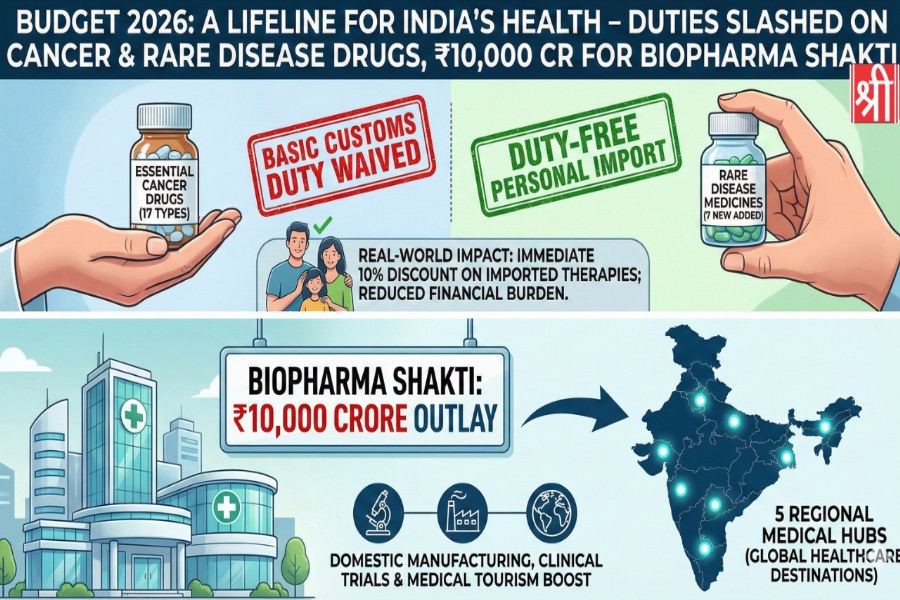

At the heart of the government’s long-term vision is the Biopharma SHAKTI (Strategy for Healthcare Advancement through Knowledge, Technology, and Innovation). Recognizing that biologic medicines are the future of longevity and quality of life, the Finance Minister proposed an massive outlay of ₹10,000 crore over the next five years.

The goal is clear: transform India into a global hub for Biopharma manufacturing. This initiative isn’t just a funding promise; it’s a structural overhaul. The strategy includes:

- Infrastructure: Establishing three new National Institutes of Pharmaceutical Education and Research (NIPER) and upgrading seven existing ones to create a world-class research network.

- Scientific Precision: Strengthening the Central Drugs Standard Control Organisation (CDSCO) by adding a dedicated scientific review cadre and specialists to meet global approval timeframes.

- Clinical Strength: Creating a network of over 1,000 accredited India Clinical Trials sites to accelerate domestic research.

Immediate Relief: A Lifeline for Cancer Patients

While “SHAKTI” builds the future, the government has provided immediate relief for those currently in the trenches of medical treatment. In a move that directly impacts the cost of chemotherapy and advanced care, the Basic Customs Duty (BCD) has been fully waived for 17 essential cancer drugs.

For eg, a family dealing with a chronic cancer diagnosis, the cost of specialized biologics and biosimilars often runs into several lakhs of rupees. By removing the standard 10% customs duty, the government has effectively provided an immediate 10% discount on the sticker price of imported life-saving therapy. This ensures that high-quality, international-standard care is no longer a luxury reserved for the few.

Expanding the Safety Net for Rare Diseases

The Budget also took a compassionate turn toward those suffering from orphan or rare diseases. The National Policy for Rare Diseases (NPRD), 2021, has been expanded significantly. The government has added seven new rare diseases to the list eligible for full duty exemptions on personal imports of drugs, medicines, and Food for Special Medical Purposes (FSMP). This move targets the “leakage” in family savings, ensuring that specialized nutritional and medicinal needs don’t lead to total financial ruin.

Five Regional Medical Hubs: India’s Global Healthcare Ambition

To capitalize on this new, lower-cost structure, the government is launching a scheme to support States in establishing five Regional Medical Hubs in partnership with the private sector. These are not just hospitals; they are integrated healthcare complexes that combine:

- Comprehensive Care: Medical, educational, and research facilities on a single campus.

- Holistic Wellness: Dedicated AYUSH Centres, rehabilitation facilities, and advanced diagnostics.

- Medical Value Tourism: Medical Value Tourism Facilitation Centres to attract global patients seeking world-class care at Indian prices.

These hubs are expected to serve as growth engines for the services sector, providing diverse job opportunities for doctors and the newly proposed cadre of 100,000 Allied Health Professionals (AHPs) that the government plans to train over the next five years.

The Real-World Impact: Healing the Wallet to Heal the Body

The true success of this Budget lies in its understanding of “Medical Debt.” By exempting interest awarded by the Motor Accident Claims Tribunal (MACT) to natural persons from income tax, the government ensures that victims of accidents receive their full compensation without further tax deductions.

From slashing duties on life-saving drugs to building a ₹10,000 crore manufacturing ecosystem, the message is clear: India is building a healthcare fortress. Every rupee saved on a customs duty or a tax exemption is a rupee that stays with a family during their most vulnerable moments.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.