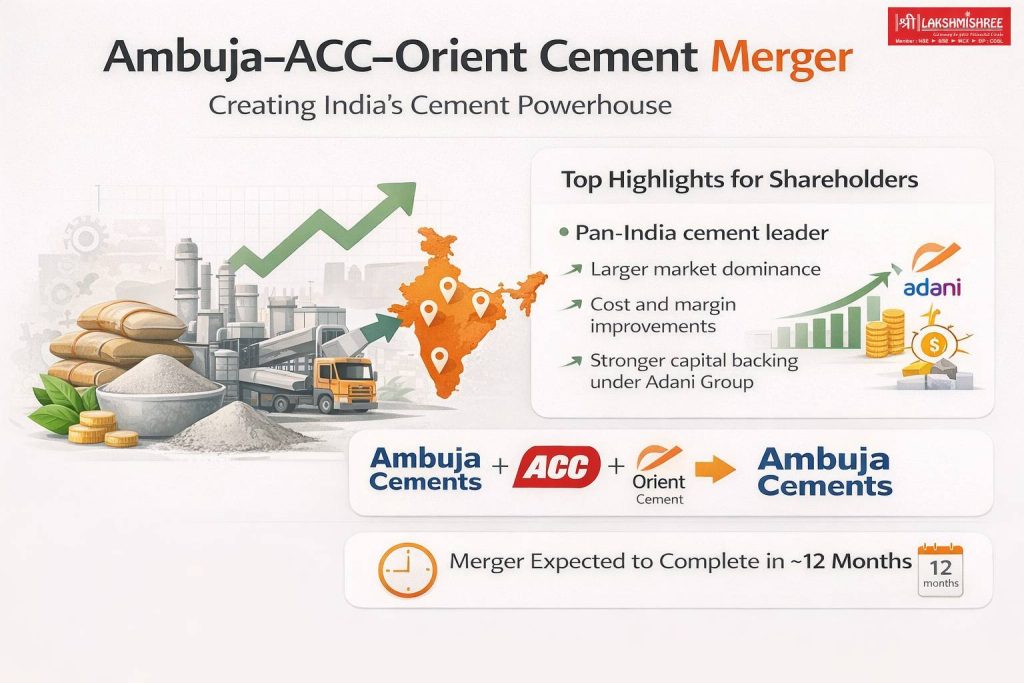

Ambuja Cements has set the stage for a major consolidation in India’s cement sector, with the boards of ACC and Orient Cement approving their merger into Ambuja. Once completed, the transaction is expected to create one of the country’s most integrated and geographically diversified cement platforms.

The merger process is likely to take up to twelve months, subject to approvals from shareholders, regulators, SEBI, and the National Company Law Tribunal (NCLT).

What Is the Strategic Rationale?

According to Ambuja Cements, Ambuja–ACC–Orient Cement Merger aims to build a pan-India cement powerhouse by:

- Optimising manufacturing and logistics networks

- Simplifying corporate and brand structures

- Improving capital allocation efficiency

- Strengthening the balance sheet

The company expects meaningful cost synergies, estimating margin improvement of at least ₹100 per tonne, driven by lower overheads, streamlined branding spends, and operational efficiencies.

Share Swap Ratios Explained

ACC–Ambuja Merger

- ACC shareholders will receive 328 shares of Ambuja Cements for every 100 ACC shares held

- At recent market prices, the value received is broadly comparable to the pre-merger value of ACC holdings

Orient Cement–Ambuja Merger

- Orient Cement shareholders will receive 33 shares of Ambuja Cements for every 100 Orient Cement shares held

- The swap ratio implies a marginal value uplift based on recent closing prices

The record dates for both mergers are yet to be announced and will determine shareholder eligibility.

What It Means for Shareholders

For shareholders of ACC and Orient Cement, the merger offers exposure to:

- A larger, more diversified cement platform

- Improved margins through scale and efficiency

- Stronger capital backing under the Adani Group umbrella

Importantly, Ambuja has clarified that the transaction is being executed on an arm’s length basis, and existing brand identities — Ambuja and ACC — will continue to operate based on product positioning and market leadership.

Bigger Picture: Cement Sector Consolidation

The merger underscores a broader trend in India’s infrastructure and building materials space, where scale, logistics efficiency, and capital strength are becoming decisive competitive advantages. As infrastructure spending and housing demand remain structurally strong, large integrated players are better positioned to benefit from volume growth and pricing stability.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.