For over a decade, India’s economic pulse was measured through a lens that had grown increasingly foggy. The 2012 Consumer Price Index (CPI) base—conceived in a pre-4G, pre-OTT, and pre-electric vehicle era—no longer reflected the reality of the Indian consumer. Today, that fog has lifted. In a landmark structural shift, the Ministry of Statistics and Programme Implementation (MoSPI) has officially retired the 2012 series, transitioning to a modernized 2024 base year.

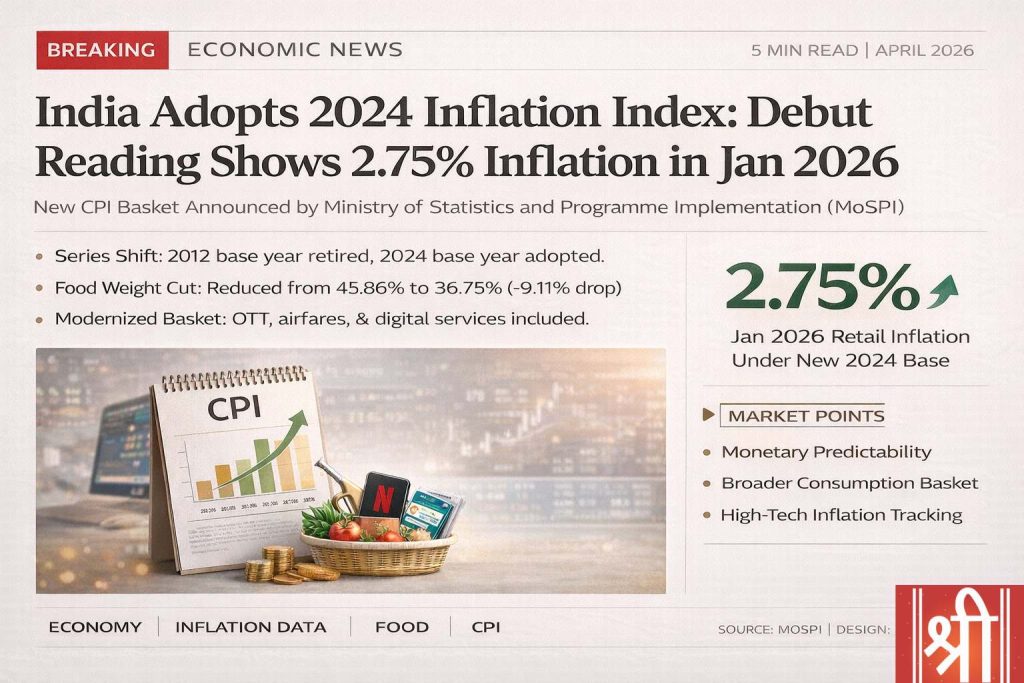

The debut reading under this new framework puts India’s annual retail inflation at 2.75% for January 2026. While the headline figure suggests stability, the “re-weighting” of the index represents a fundamental pivot in how India’s prosperity and cost of living are quantified.

Pillar 1: The Great Food Rebalancing

The most dramatic change in the 2024 series is the sharp reduction in the weight of Food and Beverages. Under the old 2012 series, food commanded a staggering 45.86% of the index. In the new 2024 framework, this has been cut to 36.75%.

Why this matters: As per Engel’s Law, as a nation grows wealthier, the proportion of income spent on food naturally declines. India has reached that inflection point. By reducing food’s weight by nearly 10 percentage points, the government has significantly lowered the “noise” in headline inflation. In the past, a seasonal spike in tomato or onion prices—often caused by temporary monsoon shocks—would send the official inflation rate soaring, forcing the Reserve Bank of India (RBI) into defensive, high-interest rate stances.

Under the new 2024 series, the RBI can now be more “surgical.” A surge in vegetable prices will no longer trigger an automatic alarm for interest rate hikes, allowing for a more stable and growth-conducive monetary policy.

Pillar 2: The Modern Basket – OTT, Airfares, and Digital Services

The 2024 series formally acknowledges that India is now a service-and-consumption-heavy nation. The basket has expanded from 299 to 358 weighted items, with a specific focus on modern digital and lifestyle services:

- Digital Subscriptions: For the first time, OTT platforms (Netflix, Amazon Prime) and digital media services are officially tracked.

- Mobility & Transport: The weightage for transport has jumped from 6.39% to 8.80%, reflecting the increased mobility of the Indian population and higher fuel consumption.

- Housing & Utilities: Urbanization is reflected in the increased weight of housing and fuel, now standing at 17.67% (up from 16.89%).

This expanded coverage ensures that the “inflation” reported by the government actually matches the monthly bank statements of an urban millennial or a rural aspirational family.

Pillar 3: The Tech-Led Data Edge

The methodology behind the 2024 series has also received a high-tech facelift. MoSPI has transitioned from paper-based reporting to Computer Assisted Personal Interview (CAPI) technology.

Data is now collected monthly via tablet-based software across 1,465 rural markets and 1,395 urban markets. This digital-first approach allows for real-time validation, minimizing human error and ensuring that price data for volatile items like airfares and e-commerce prices are pulled directly from online platforms. Furthermore, the government has institutionalized a revision cycle of every 3 to 5 years, ensuring that India’s economic mirror never remains static for a decade again.

The Macro Impact: RBI, EMIs, and Market Sentiment

For the investment community at firms like Lakshmishree, the 2024 CPI series is a “bullish” signal for three key reasons:

- Monetary Predictability: A less volatile headline inflation number gives the RBI more room to consider interest rate cuts. With the January reading at a benign 2.75%, the path toward lower EMIs for home and personal loans has become much clearer.

- Strategic Autonomy: By aligning the CPI basket with modern consumption, India’s monetary policy becomes less vulnerable to global food price shocks, allowing for domestic growth-focused decisions.

- Fiscal-Monetary Alignment: The transition coincides with a broader push for fiscal consolidation. A modernized CPI helps the government better target social protection and subsidy programs, reducing overall fiscal waste.

Bottom Line: A Clearer Mirror for Amrit Kaal

India is no longer a “thali-driven” economy; it is a nation driven by data, services, and structural growth. By shifting the base to 2024, MoSPI has provided a clearer mirror of our economic reality. This is not just a change in a spreadsheet; it is a recognition of India’s evolving socio-economic status. For the retail investor, it means more predictable markets, and for the common citizen, it means that the “inflation” discussed on news channels finally feels real.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.