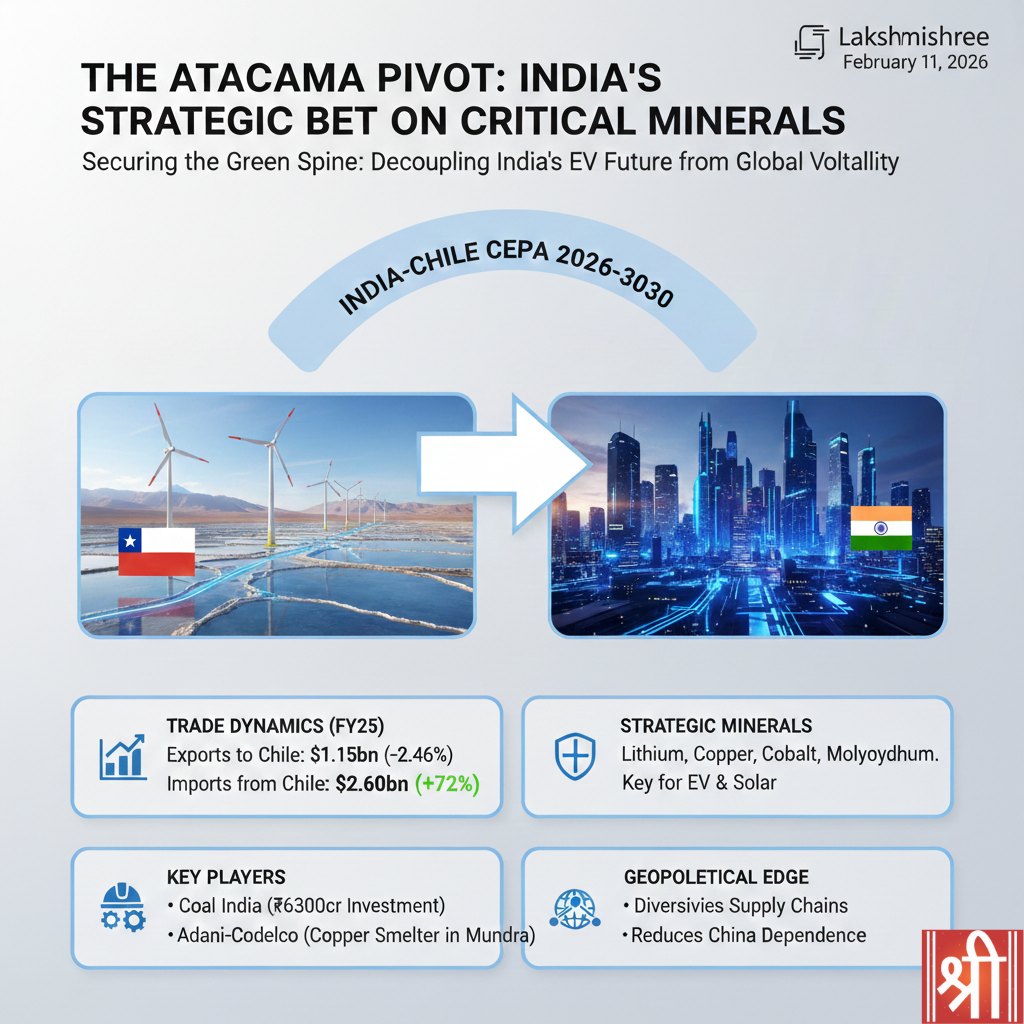

As the global race for resource security intensifies, India is quietly nearing the finish line of what may become its most consequential trade agreement of the decade. The impending India-Chile Comprehensive Economic Partnership Agreement (CEPA) is shifting from a standard trade discussion to a high-stakes strategic pillar, designed to secure the raw materials essential for India’s high-tech manufacturing and green energy future.

Securing the “Green” Backbone

At the heart of the negotiations is India’s urgent need for “Critical Minerals”—a term that has moved from the periphery of industrial policy to the center of national security. Chile, a South American mining powerhouse, holds the world’s largest reserves of Lithium and Copper, alongside significant deposits of Rhenium, Molybdenum, and Cobalt.

For New Delhi, this is not merely about importing commodities; it is about breaking the stranglehold of concentrated global supply chains. With India targeting 30% EV penetration by 2030 and a massive expansion in solar infrastructure, the Chile FTA provides a direct, institutionally anchored pipeline to the Atacama Desert’s mineral wealth.

The Strategy: From Diplomacy to Direct Investment

The Indian government is no longer relying solely on market forces to secure these minerals. Instead, it is deploying a “PSU-plus-Private” pincer strategy:

- Coal India’s International Pivot: In a landmark move this February, the board of Coal India Ltd (CIL) approved the incorporation of an intermediate holding company in Chile. With an investment clearance exceeding ₹6,300 crore, the state-owned giant is diversifying into lithium and copper exploration—marking its first significant overseas foray into the critical minerals space.

- The Adani-Codelco Alliance: On the private side, Adani Enterprises (via Kutch Copper) has signed an MoU with the Chilean state miner Codelco. This agreement focuses on joint exploration in the Antofagasta and Atacama regions. The minerals extracted are expected to feed Adani’s 1-million-tonne copper smelter in Mundra, Gujarat, ensuring a fully integrated supply chain from Chilean mines to Indian factories.

Trade Statistics: A Surge in Strategic Imports

While India’s overall export growth remains a point of focus for the Ministry of Commerce, the trade data with Chile reveals a sharp strategic shift:

| Metric (FY 2024-25) | Value | Trend |

| India Exports to Chile | $1.15 Billion | -2.46% (Focus: Cars & Pharma) |

| India Imports from Chile | $2.60 Billion | +72% (Focus: Copper & Molybdenum) |

| Trade Deficit | $1.45 Billion | Reflects India’s hunger for industrial inputs |

The 72% surge in imports is almost entirely driven by copper and molybdenum, underscoring the “mineral-first” nature of the current bilateral relationship.

Geopolitical Context: Decoupling from the Dragon

A primary driver behind the urgency of the Chile CEPA is the systemic rivalry with China. Beijing currently controls roughly 70% of global rare earth refining and has frequently used export controls as a diplomatic weapon.

By securing a CEPA with Chile, India is implementing its National Critical Mineral Mission, which emphasizes diversifying sourcing to avoid “single-country dependencies.” Commerce Minister Piyush Goyal recently highlighted this shift, noting that India is no longer engaging from a “position of hesitation” but with the confidence of the world’s fastest-growing large economy.

The Outlook for 2026 and Beyond

The conclusion of the India-Chile FTA will likely include a dedicated chapter on investment promotion in the mining sector, potentially granting Indian firms preferential rights for exploration.

As the “Amrit Kaal” goals take shape, the silent pivot toward South America may well be remembered as the moment India secured the physical foundations of its digital and green revolution.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.