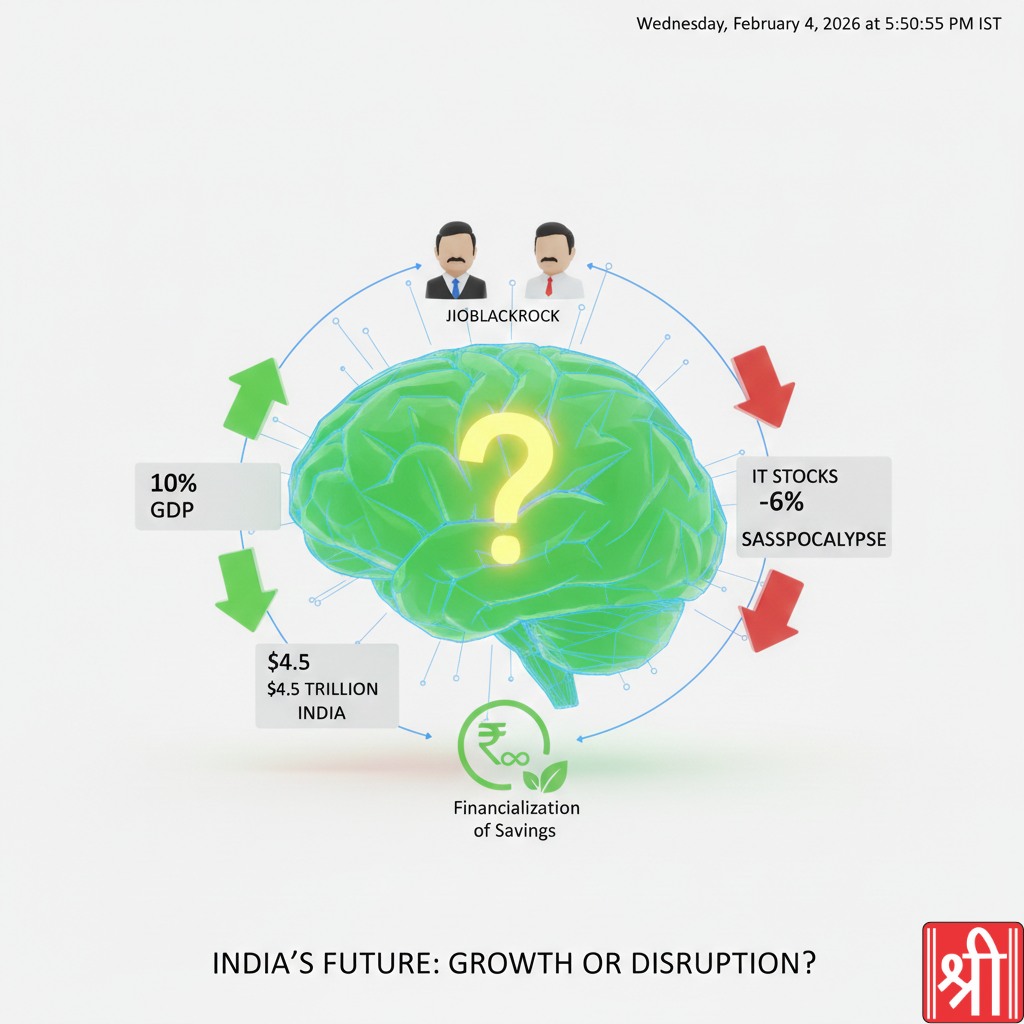

Mukesh Ambani (RIL) and Larry Fink (BlackRock) confirmed a sustained 10% GDP growth roadmap for India today at the JioBlackRock Summit. Ambani projected a $4.5 Trillion financial opportunity, targeting “unproductive” domestic savings to fuel a 30-year expansion cycle.

Event: JioBlackRock “Investing for a New Era” Summit, Mumbai

Key Figures: Mukesh Ambani (RIL), Larry Fink (BlackRock)

Market Context: Nifty IT -5.6% vs. Manufacturing/Export Breakout

1. The “Double-Digit” Pivot

Mukesh Ambani projected a sustained 8% to 10% GDP growth trajectory. He argues that India is no longer just “catching up” but is now a global outlier benefiting from a “Policy Continuity” dividend.

- Growth Logic: India is described as a “tree bearing fruit.” While mature Western markets face “deceleration,” India’s youthful demographic and manufacturing push create a unique growth window.

- The $4.5 Trillion Anchor: This isn’t just a number; it is the Total Addressable Market (TAM) for financial services as India targets a $5T GDP milestone.

- Social Prerequisite: Ambani emphasized that economic speed is impossible without “Social Harmony” positioning stability as a core business asset.

2. JioBlackRock: Monetizing “Unproductive” Savings

The 50:50 JV aims to “financialise” the trillions of rupees currently “trapped” in unproductive assets like gold and idle savings accounts.

- The Mission: To transform India from a “Nation of Savers” into a “Nation of Investors.”

- The Tech (Aladdin®): By using BlackRock’s Aladdin system, a middle-class clerk in Indore gets the same high-tier risk analytics as a hedge fund manager in New York.

- Pricing Psychology: The ₹350/year fee is “Sachet Pricing”—designed to be cheaper than a single OTT subscription, removing the “advice is too expensive” barrier.

3. Energy & Geopolitics: The 80% Dependency Reset

Ambani signaled a decade-long pivot to end India’s 80% energy import dependency, which has historically kept the Rupee (INR) vulnerable.

- The Pivot: Shifting from “Imported Carbon” to “Home-grown Electrons.” This moves India from a trade deficit to potential energy sovereignty.

- Infrastructure Scale: The 5,000-acre Jamnagar Giga Complex is four times the size of a Tesla Gigafactory—it is the literal engine of India’s Net-Zero 2035 target.

- Currency Stability: As energy imports drop, the Rupee stabilizes. We are already seeing a recovery to the 90.30 range.

4. AI Narrative: SaaSpocalypse vs. Geopolitical Win

Larry Fink addressed the -6% crash in IT stocks, reframing the “Anthropic Effect” not as a bubble, but as a Darwinian filter.

The IT Shift: The “Headcount Model” (charging per person) is dying. The future is “Skill-First” (charging for the outcome).

Fink’s Warning: “China will win if we don’t invest in AI.“ He views AI as a Geopolitical Imperative, not just a tech trend.

The Survival Rule: Companies that “fear” AI will be replaced; companies that “integrate” Agentic AI will dominate.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.