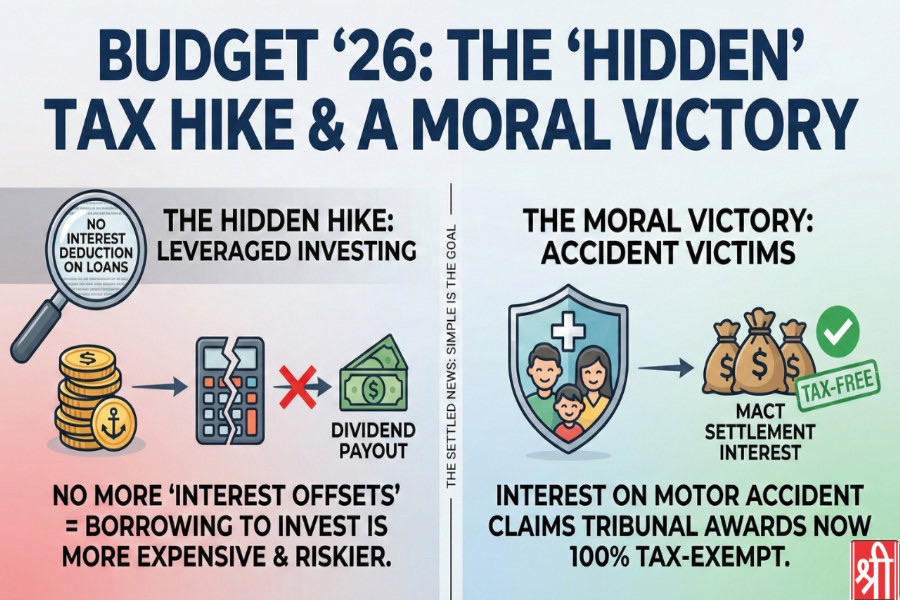

While most people are talking about the stock market crash and the new tax rates, a small detail buried in the “fine print” of Budget 2026-27 is about to change the game for investors. It’s a technical move that many missed, but it will have a massive impact on anyone who uses loans to grow their wealth.

- The Change: No More ‘Interest Offsets’

Until now, if you borrowed money to buy stocks or mutual funds, the government allowed you to “balance” the cost. You could take the interest you paid on that loan and subtract it from the dividends you earned, effectively lowering your taxable income.

The New Rule: Starting soon, you can no longer deduct any interest expenses against your dividend or mutual fund income. Every rupee you earn in dividends will be taxed at your full slab rate, regardless of how much interest you are paying to the bank or broker to hold those investments.

Why This Matters: The Death of ‘Leveraged’ Investing

This change hits a very specific, popular strategy called Leveraged Investing.

- The Old Way: Investors would take a “Loan Against Shares” or use a “Margin” from their broker to buy more stocks. They would use the dividends to help pay off the loan’s interest and get a tax break on that interest.

- The New Reality: The “math” no longer works. You will pay the bank full interest on your loan, AND you will pay the government full tax on your dividends. This makes borrowing money to invest much riskier and significantly less profitable.

Who Should Be Worried?

You won’t feel this impact today, but you will notice it when you file your first tax return under the Income Tax Act 2025. It primarily impacts:

- Wealthy Investors: Those who use property or existing portfolios as collateral to buy high-dividend stocks.

- Professional Traders: Those who rely on broker margins to hold positions for long periods.

- Company Promoters: This move, combined with the new Buyback Tax, makes it much harder for promoters to take money out of their companies tax-efficiently.

A Moral Victory: The ‘Human’ Side of the Budget

To balance this “hidden” hike, the government fixed a long-standing injustice for accident victims.

- The Win: Any interest awarded by the Motor Accident Claims Tribunal (MACT) to an individual is now 100% tax-free.

- The Impact: Previously, if a victim received a settlement after years of waiting, the “interest” on that money was taxed heavily. Now, the government has stopped taking a cut from the compensation meant for victims and their families.

The Bottom Line

The Budget is sending a clear message: “Trust-based” and “simple” is the goal. The government wants to move away from complex tax-saving tricks (like interest offsets) and toward a system where you pay tax on what you earn, plain and simple. While it hurts the “borrow-to-invest” crowd, it provides a much-needed shield for the most vulnerable citizens.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.