Finance Minister Nirmala Sitharaman has announced a significant increase in the Securities Transaction Tax (STT) on derivative transactions (Futures and Options) during the Union Budget 2026-27 presentation. This move is aimed at curbing excessive short-term speculation in the markets while boosting government revenue.

What are the New Rates?

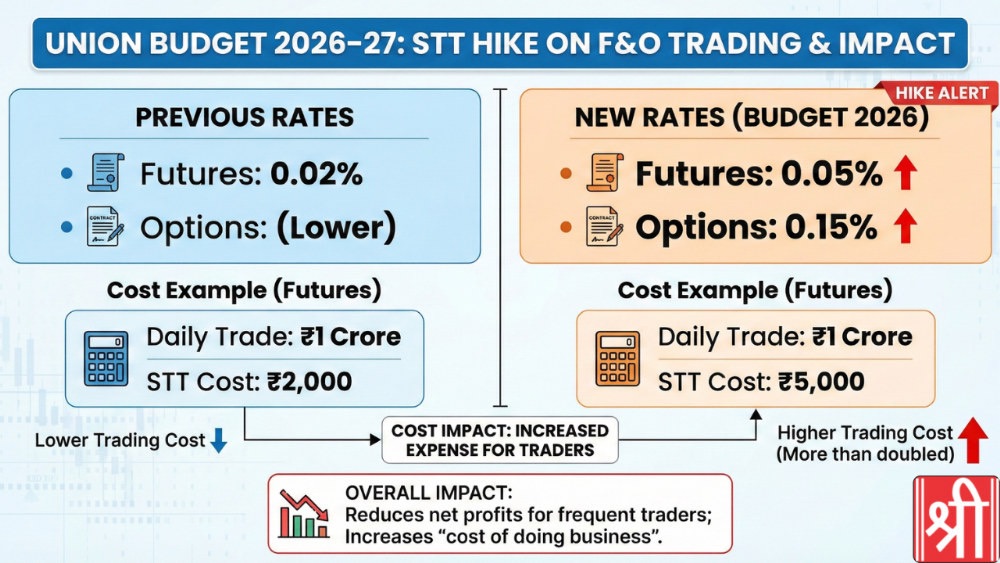

The tax has been hiked for both Futures and Options segments:

• Futures Trading: The Securities Transaction Tax (STT) has increased from 0.02% to 0.05% of the transaction value.

• Options Trading: The STT has increased to 0.15% of the transaction value.

Simple Definitions: What do these words mean?

• Securities Transaction Tax (STT): Think of this as a “toll tax” for the stock market. Every time you buy or sell a stock or derivative, the government takes a small percentage as a fee.

• Futures & Options (F&O): These are “derivative” contracts. Instead of buying a whole company, you are betting on whether the price of a stock will go up or down by a certain date. It is a high-risk, high-reward type of trading.

• Buyback Tax: When a company buys back its own shares from you, the profit you make will now be taxed as Capital Gains, similar to when you sell a stock for a profit.

The Impact: An Example

To understand how this affects your pocket, let’s look at a frequent trader’s scenario:

Scenario: Imagine you trade ₹1 Crore worth of Nifty Futures daily.

Under the Old Rate (0.02%): You paid ₹2,000 in STT.

Under the New Rate (0.05%): You will now pay ₹5,000 in STT.

The Result: Your “cost of doing business” has more than doubled. If you make 100 such trades a year, you are now paying ₹3 Lakhs extra to the government, which directly reduces your net take-home profit.

Why did the Market Crash?

Following the announcement, both the Sensex and Nifty saw a sharp decline. Professional traders and institutional investors (big players) often trade in massive volumes. This tax hike increases their expenses significantly, leading to immediate selling pressure as they adjust their strategies to account for higher costs.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.