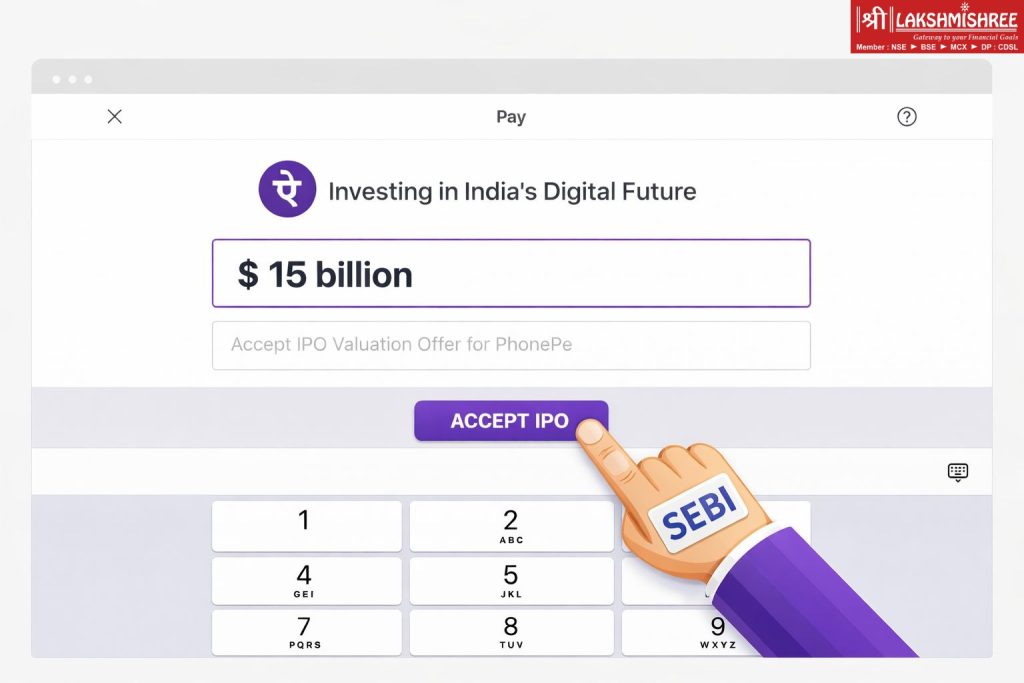

India’s digital payments leader PhonePe’s IPO has received approval from the Securities and Exchange Board of India (SEBI), marking a decisive step toward one of the country’s most closely watched fintech listings. The Bengaluru-headquartered company is expected to seek a valuation of around $15 billion and raise approximately ₹12,000 crore through a pure offer for sale (OFS), according to people familiar with the matter.

With this clearance, PhonePe is set to become the second-largest “new economy” IPO in India in 2026, after Paytm’s 2021 listing, and the most significant fintech market debut since the sector’s post-pandemic reset.

A milestone for India’s UPI ecosystem

PhonePe’s IPO is more than a corporate fundraising event—it represents the public market debut of the most dominant player in India’s Unified Payments Interface (UPI) ecosystem. The platform commands roughly 45 percent market share in UPI transactions, ahead of Google Pay’s estimated 35 percent, and processes close to 10 billion transactions every month, with a total transaction value exceeding ₹12 lakh crore.

Given that UPI now accounts for over 85 percent of India’s digital payment volumes, PhonePe has become deeply embedded in the country’s financial infrastructure. This scale and consistency are central to the investment case, especially at a time when public market investors have grown more selective about fintech profitability and business durability.

Unlike many consumer internet companies that rely heavily on incentives to drive usage, PhonePe has maintained its leadership position even as competition intensified and regulatory scrutiny around UPI pricing increased.

Structure of the IPO and selling shareholders

The proposed PhonePe’s IPO will be a pure OFS, meaning no fresh capital will be raised by the company. Instead, existing shareholders will dilute their stakes. Key sellers are expected to include Walmart, which is the majority owner, along with Tiger Global and Microsoft. Collectively, these shareholders are likely to offload around 10 percent of their holdings.

PhonePe had filed its draft red herring prospectus (DRHP) through SEBI’s confidential pre-filing route in September 2025, a mechanism increasingly used by large issuers to test regulatory waters before going public. The company is now expected to submit an updated DRHP in the coming days, paving the way for a formal launch timeline.

Global investment banks Kotak Mahindra Capital, Citi, Morgan Stanley, and JP Morgan are advising on the offering.

Valuation context: lessons from past fintech IPOs

The targeted $15 billion valuation places PhonePe below Paytm’s IPO valuation of roughly $20 billion in 2021 but significantly above the levels at which many fintech peers are currently trading.

The contrast with Paytm is instructive. Although Paytm’s IPO was fully subscribed, its valuation declined sharply in the aftermath due to concerns over profitability, regulatory changes, and business model sustainability. Paytm’s current valuation is estimated at around $9.5 billion, well below its listing level.

By comparison, other fintech listings have delivered more stable outcomes. PB Fintech, the parent of Policybazaar, has seen its valuation rise to around $9 billion, up from roughly $6 billion at listing, while wealth-tech platform Groww listed at approximately $7.5 billion and is now valued closer to $10.5 billion.

Market participants note that PhonePe’s stronger fundamentals—particularly its dominance in a mission-critical payments rail—could help it avoid some of the post-listing volatility that affected earlier fintech IPOs.

Beyond payments: diversification with discipline

While payments continue to anchor PhonePe’s business accounting for over 90 percent of total revenue the company has gradually expanded into adjacent financial services. These include its stock trading platform Share Market, insurance distribution, and lending partnerships.

Unlike aggressive diversification strategies seen in earlier fintech cycles, PhonePe’s expansion has been relatively measured, with a focus on leveraging its existing user base rather than chasing growth at any cost. Investors are expected to scrutinise how these newer verticals contribute to revenue growth and margin improvement over the medium term.

Why this IPO matters

PhonePe’s listing comes at a time when India’s capital markets are reassessing the value of scale, profitability pathways, and regulatory resilience in technology-driven businesses. The company’s continued dominance in UPI, even in a zero-merchant-discount-rate environment, positions it as a rare fintech with both reach and defensibility.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.