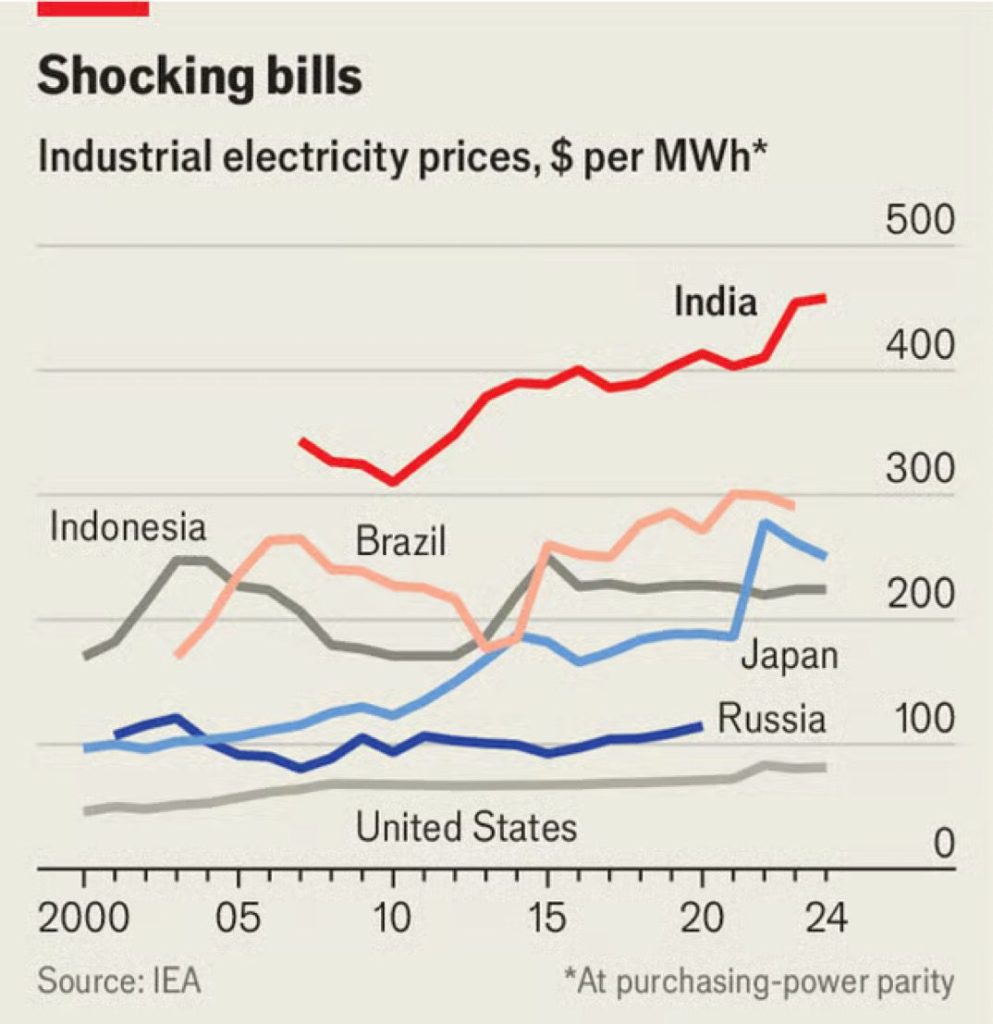

Industrial electricity prices in India have climbed sharply in recent years compared with many other large economies, creating mounting pressure on manufacturers and exporters. A widely shared chart shows India’s industrial electricity prices rising well above those in countries like Indonesia, Brazil, Japan, Russia, and the United States — with India’s rate often exceeding 400+ USD per megawatt-hour (MWh) in recent estimates. This surge not only impacts production costs but is a growing concern for global competitiveness, investment attraction and the broader growth outlook for Indian manufacturing.

The trend reflects more than transient market movements; it captures structural features of India’s power sector, tariff design, grid practices, taxation, and policy trade-offs. Understanding why industrial electricity prices are comparatively high and what it means for Indian industry can shed light on both short-term economic pressures and long-term policy challenges.

What the Data Shows: Industrial Electricity Prices in Global Perspective

The International Energy Agency (IEA) and other tracking sources provide historical data showing industrial electricity prices across major economies. While wholesale prices for electricity have moderated in many regions following global energy price declines, India still registers significantly higher prices for industrial users compared with developed economy peers.

In the chart dominating industry discussions, India’s industrial electricity price line stands well above those of Indonesia, Brazil, Japan, Russia and the United States, with Indian costs approaching or exceeding 400+ USD/MWh, whereas the United States stays near the bottom of the range. This implies that for every megawatt-hour of power consumed, Indian industry is paying a substantially larger bill than many competitor nations.

It’s important to note that electricity price comparisons vary by methodology i.e. some reflect wholesale generation costs, others include transmission, distribution and taxes. India’s retail industrial tariffs, which include distribution and supply costs, stood around ₹10.49/kWh (about 0.119 USD/kWh) for businesses in 2025, reflecting total cost to the consumer rather than just wholesale supply.

These levels matter intensely for energy-intensive sectors such as steel, cement, chemicals, engineering goods, textile manufacturing, and food processing, where power costs are a large share of operating expenses.

Why India’s Industrial Electricity Prices Are High

Several factors contribute to the elevated electricity prices for industrial consumers in India:

1. Distribution and Mark-ups Embedded in Final Tariffs

Unlike some economies where industrial prices are closely aligned with generation costs, Indian manufacturers often face tariffs that include significant mark-ups. According to media reporting and economic surveys, industrial users in India may pay a 10–25% markup over the cost of electricity supply — a margin that directly increases final bills and reduces competitiveness.

These mark-ups are partly the result of state-level tariff setting, cross-subsidisation between consumer categories, and the financial stress of distribution utilities, which rely on tariff margins to cover losses and legacy costs.

2. The Role of Billing Systems

Recent changes in billing practices also influence prices. For example, Maharashtra introduced a kVAh billing system for industrial low-tension consumers, charging for total apparent power rather than just real energy consumed. This change, while intended to curb losses and improve efficiency, has reportedly increased bills by up to 50% for some units because unproductive consumption (poor power factor) now attracts charges.

Technical inefficiencies and lack of optimisation at factory sites such as poor power factor can thus convert into higher bills under newer billing regimes.

3. Electricity Market Structure and Recovery Costs

India’s electricity sector is governed by a framework that balances cost recovery, universal access, subsidised categories, and regulatory mandates under acts such as The Electricity Act, 2003.

While the Act aims to rationalise tariffs and promote competition, practical implementation often leaves distribution companies under pressure to recover fixed costs and cover network investments, which are then reflected in tariff schedules.

4. Generation Mix and Peak Pricing

India’s generation mix is dominated by thermal (coal) and increasingly renewable sources. Coal and renewables make up large shares of installed capacity, but grid balancing, peak demand pressures, and the limited role of marginal sources like gas can influence the overall cost structure. In contrast, markets like the EU and US may have different cost drivers; Europe’s higher prices are often attributed to gas reliance and carbon pricing, but India’s remain structurally high even with cheaper generation sources.

Implications for Indian Industry and Competitiveness

The consequences of high industrial electricity prices are multifaceted:

Cost of Production and Export Competitiveness

Electricity is a significant input cost in many manufacturing supply chains. When Indian firms pay much higher prices per MWh than competitors in the US, Russia or parts of Southeast Asia, this erodes cost competitiveness, particularly in export markets where energy costs factor into global pricing decisions.

Investment Decisions and Location Choices

Multinational and domestic investors often consider energy costs in site selection. Regions offering lower and stable electricity tariffs attract high-energy-use industries such as data centers, chemicals, steel, aluminium and manufacturing clusters.

Pressure from Industry Associations

Industry bodies in states like Haryana have protested against sharp tariff increases, arguing that sudden hikes in fixed charges and per-unit prices stifle business expansion and threaten sustainability of small and medium enterprises.

Similarly, opposition to costly technical mandates (like power quality meters) reflects anxiety about additional cost burdens on industrial users.

Policy Responses and Future Direction

Recognising the drag of high energy costs on industry, some states and regulators are experimenting with relief measures. For instance, Haryana announced a subsidised electricity tariff of ₹2 per unit for micro and small enterprises under specific schemes, aimed at easing energy costs and improving competitiveness for smaller units.

Policymakers and industry stakeholders are also debating broader reforms, including:

- Rationalising tariff structures to reduce cross-subsidies and mark-ups,

- Promoting energy efficiency and power factor correction to avoid penal charges,

- Enhancing grid flexibility and demand response to reduce peak pricing pressures,

- Encouraging renewables and storage to mitigate volatility,

- Considering industrial tariff reforms to align with international benchmarks.

International Comparisons and Context

While India’s industrial electricity prices are high relative to some peers, global comparisons reveal wide variation depending on market design, fuel mix, policy choices and environmental levies. In the EU, for example, electricity prices for heavy industry often remain higher due to carbon costs and renewable subsidies, even as policy debates continue around competitiveness pressures.

Wholesale electricity prices in many regions fell in 2024 compared to the previous year, including in India, but remain above pre-Covid levels in many markets.

Kaashika is a social media strategist and financial content creator at Lakshmishree. She specialises in simplifying complex IPO and stock market concepts into clear, easy-to-understand content. Having created over 500+ pieces of financial content across reels, blogs, website posts and digital creatives, Kaashika helps audiences connect with the world of finance in a more accessible and engaging way.